Meeting Notice

The Ordinary Council Meeting

of Central Coast Council

will be held in the Council Chamber,

2 Hely Street, Wyong

on Tuesday 28 February 2023 at 6.30pm,

for the transaction of the business listed below:

The Public Forum

will commence at 5.45pm, subject to any registered speaker/s to items listed on

this agenda.

Further

information and details on registration process: www.centralcoast.nsw.gov.au/council/meetings-and-minutes/council-meetings

2 Reports

2.4 Presentation of 2021-2022 Financial Reports and related Auditor's Reports for Central Coast Council and Central Coast Council Water Supply Authority........................................................ 4

Supplementary Agenda Version History

|

Version |

Date published |

Details |

|

1 |

24/02/2023 |

Included 4 attachments |

|

2 |

27/02/2023 (this version) |

Attachments updated with final NSW Audit Office adjustment Consolidated to 2 attachments |

David Farmer

Chief Executive Officer

AMENDED REPORT

|

Item No: 2.4 |

|

|

Title: Presentation of 2021-2022 Financial Reports and related Author’s Reports for Central Coast Council and Central Coast Council Water Supply Authority |

|

|

Department: Corporate Services |

|

|

28 February 2023 Ordinary Council Meeting |

|

Reference: F2022/00467 - D15261971

Author: Emma Galea, Chief Financial Officer

Executive: Marissa Racomelara, Director Corporate Services

1 That Council note that the 2021-2022 Central Coast Council audited financial reports including the auditor’s reports have been presented to this meeting of the Council, in accordance with s. 419(1) of the Local Government Act 1993 (“LG Act”).

2 That Council adopt the audited 2021-2022 financial reports for Central Coast Council as presented in accordance with ss. 413(2)(c) and 377(1)(k) of the LG Act, and cl. 215(1)(a) of the Local Government (General) Regulation 2005.

3 That Council include the audited 2021-2022 Central Coast Council Consolidated Financial Reports in Council’s 2021-2022 Annual Report in accordance with s.428(4)(a) of the LG Act.

4 That Council publish on Council’s website the 2021-2022 Central Coast Council Consolidated Financial Reports as an addendum to the 2021-2022 Annual Report and a copy be provided to the Minister of Local Government in accordance with s. 428 (5) of the LG Act.

5 That Council adopt the audited 2021-2022 financial reports for Central Coast Council Water Supply Authority as presented in accordance with s.45 of the Water Management Act, Australian Accounting Standards and other pronouncements of the Australian Accounting Standards Board.

|

Report purpose

This report presents the final 2021-2022 Consolidated Financial Reports for Central Coast Council and Central Coast Council Water Supply Authority. The Financial Reports cover the period from 1 July 2021 to 30 June 2022.

This report summarises the amendments made to the Financial Reports that have been made subsequent to the Draft Financial Statements being presented to Council on 27 September 2022.

Executive Summary

This report, presents the 2021-2022 Financial Reports for Central Coast Council and Central Coast Council Water Supply Authority.

The net assets for Central Coast Council as at 30 June 2022 total $8.3 billion.

The net assets for Central Coast Council Water Supply Authority as at 30 June 2022 total $4.1 billion. |

Background

The draft financial reports for Central Coast Council and Central Coast Council Water Supply Authority were presented to Council at its meeting held on 27 September 2022 and Council resolved as follows:

254/21 Resolved

1 That Council note that the draft Consolidated Financial Reports for Central Coast Council for the period from 1 July 2021 to 30 June 2022 are presented to Council. The Consolidated Financial Report includes the General Purpose financial report, Special Purpose financial report and Special Schedules, which is Attachments 1 to the business paper.

2 That Council also note that the draft Consolidated Financial Reports have been prepared in accordance with the requirements of the Local Government Act 1993 (“LG Act”), the Local Government (General) Regulation 2005 (“LG Reg”) and the relevant accounting and reporting requirements of the Office of Local Government prescribed Code of Accounting Practice and Financial Reporting 2020/21 and Australian Accounting Standards.

3 That Council note that the draft Financial Reports for Central Coast Council Water Supply Authority for the period from 1 July 2021 to 30 June 2022 is presented to Council, which is Attachment 2 to the business paper.

4 That Council note that the draft Financial Reports for Central Coast Council Water Supply Authority as presented are in accordance with s.45 of the Government Sector Audit Act 1983, the Public Finance and Audit Regulation 2015, Australian Accounting Standards and other pronouncements of the Australian Accounting Standards Board.

5 That Council authorise, the Administrator, given the suspension of the Mayor, to execute all documents related to the draft 2021-2022 Consolidated Financial Reports in accordance with s413(2)(c) of the LG Act, and cl. 215(1)(b)(i) of the LG Reg.

6 That Council authorise, the Chief Executive Officer to execute all documents related to the draft 2021-2022 Consolidated Financial Reports in accordance with s413(2)(c) of the LG Act, and cl. 215(1)(b)(iv) of the LG Reg.

7 That Council authorise, the Responsible Accounting Officer of the Council, to execute all documents related to the draft 2021-2022 Consolidated Financial Reports with s413(2)(c) of the LG Act, and cl. 215(1)(b)(iii) of the LG Reg.

8 That Council authorise, for the purposes of s.45 of the Government Sector Audit Act 1983, its Administrator, Chief Executive Officer and Responsible Accounting Officer to execute all documents related to the draft 2021-2022 Financial Reports for Central Coast Council Water Supply Authority.

9 That Council resolve, for the purposes of s. 413(1) of the LG Act, to refer the draft Consolidated Financial Reports for Central Coast Council and the draft Financial Reports for Central Coast Council Water Supply Authority for the period from 1 July 2021 to 30 June 2022 to the Audit Office of New South Wales, for external audit.

10 That Council delegate to the Chief Executive Officer to set the date for the meeting to present the audited 2021-2022 financial reports, together with the auditor's reports, to the public in accordance with s418(1)(a), (b) of the LG Act.

Current Status

Central Coast Council

The 2021-2022 Central Coast Council Consolidated Financial Reports include the General Purpose financial statements, Special Purpose financial statements and Special Schedules, which include all of Council’s business activities. The 2021-2022 Central Coast Council Consolidated Financial Reports comprise Attachment 1, 2 and 3 to this business paper.

The Central Coast Council Financial Reports have been prepared in accordance with the requirements of the Local Government Act 1993 (“LG Act”), the Local Government (General) Regulation 2005 (“LG Reg”), and the relevant accounting and reporting requirements of the Office of Local Government prescribed Code of Accounting Practice and Financial Reporting 2021/22 and Australian Accounting Standards.

In accordance with s. 413(1) of the LG Act, Council must prepare financial reports for each year, and must refer them for audit as soon as practicable after the end of that year.

The Audit, Risk and Improvement Committee met on 14 September 2022 and reviewed the draft 2021-2022 Central Coast Council Financial Reports. The Committee recommended that Council refer the draft 2021-2022 Central Coast Council Consolidated Financial Reports to audit (that include the General Purpose financial statements, Special Purpose financial statements and Special Schedules).

It is proposed that Council now formally adopt the 2021-2022 Central Coast Council Financial Reports.

Pursuant to resolution 254/21 of 27 September 2022, the draft 2021-2022 Financial Reports of Central Coast Council were referred to Council’s external auditor, The Audit Office of New South Wales.

The audit reports from The Audit Office of New South Wales, pursuant to s. 419(1) of the LG Act, will be presented to this meeting of Council.

Central Coast Council Water Supply Authority

The 2021-2022 Central Coast Council Water Supply Authority Financial Reports have been prepared in accordance with the Water Management Act and Australian Accounting Standards. Council is required to prepare financial reports for Central Coast Council Water Supply Authority each year. The 2021-2022 Central Coast Council Water Supply Authority Financial Reports comprise Attachment 4 to this business paper.

The Audit, Risk and Improvement Committee met on 14 September 2022 and reviewed the 2021-2022 Central Coast Council Water Supply Authority Financial Reports. The Committee recommended that Council refer the draft 2021-2022 Central Coast Council Water Supply Authority Financial Reports to audit.

It is proposed that Council now formally adopt the 2021-2022 Central Coast Council Water Supply Authority Financial Reports.

Pursuant to resolution 254/21 of 27 September 2022, the draft 2021-2022 Financial Reports of Central Coast Council Water Supply Authority were referred to Council’s external auditor, The Audit Office of New South Wales.

Amendments to the 2021-2022 Financial Reports

Subsequent to the presentation of draft 2021-2022 Financial Reports to Council on 27 September 2022 a number of amendments have been made within the Reports. The tabled amendments impact a number of Notes to the Financial Reports in the General Purpose Financial Statements, Water Supply Authority Financial Statements and Special Purpose Financial Statements. There have also been a number of minor typographical and rounding changes to improve clarity of the Notes. The key changes that have been made include the following items that have been reflected in the final Financial Reports:

· Water and Sewer Infrastructure, Property, Plant and Equipment revaluation results.

· Roads and Drainage Infrastructure, Property, Plant and Equipment revaluation results.

· Community and Recreation Services Infrastructure, Property, Plant and Equipment revaluation results.

· Recognition of found assets through the revaluation process.

· Impacts of the International Financial Reporting Interpretations Committee (IFRIC) 'Software as a Service’ (SaaS) agenda decision (adjustment to opening IPPE and Intangible assets values)

· Amendment to the fair value of operational land.

· Amendment to the fair value of community and crown land

· Amendment to the fair value of buildings

· Capitalisation of Mardi to Warnervale Trunk Main

· Reversal of FY21 Sewerage Network revaluation decrement following FY22 indexation increase applied to sewerage network assets.

In 2021-22, Council reconciled its 30 June 2021 technical asset register and fixed asset register (pre-2021 valuation) to ensure the accuracy and completeness of the opening asset balances (which was subject to audit qualification at 30 June 2021).

This was a detailed exercise performed by Council involving collaboration between asset owners/engineers, finance, and engagement of independent valuers.

Council engaged GHD and Morrison Low (independent valuers) to provide assurance on the reasonableness of the Council's reconciliation process and the results thereof, and to provide an updated valuation as at 30 June 2021 after considering the impact of any assets found, disposed, and other asset anomalies (incorrect unit rates, measurements, condition assessments applied in the previous valuation) identified as part of the reconciliation process.

Prior period errors were adjusted retrospectively due to fair value assessments and the reconciliation of the technical asset register and the fixed asset register.

The correction of errors is disclosed in Note G4-1 of the GPFS, and Note F4-1 of the WSA financial statements.

The Audit Office obtained sufficient appropriate audit evidence to support the opening balances for relevant IPPE balances at 1 July 2021 and closing balances at 30 June 2022 to support removal of the modified audit opinion on the 30 June 2022 GPFS, SPFS, and WSA financial statements.

2021-2022 Financial Statements

The following analysis provides an overview of the changes made to the key statements since presentation to Council on 27 September 2022. Key statements and notes detailed in this analysis include:

· Income Statement

· Statement of Financial Position

· Statement of Performance Measures (Note G5 to the financial statements)

Council’s primary financial statements are in the format required by accounting standards and must conform to the provisions of the Local Government Code of Accounting Practice and Financial Reporting (Guidelines) issued by the Office of Local Government (OLG).

Consolidated Financial Statements

Following is a comparison of the financial performance for Central Coast Council as presented in the Draft 2021-2022 Financial Statements on 27 September 2022 compared to the final Financial Statements for 2021-2022 attached to this report.

Operating Result

The operating surplus before capital grants and contributions presented in the draft 2021-2022 Financial Reports was $47.3M and the operating result including capital grants and contributions of $61.5M was a surplus of $108.8M.

The operating surplus before capital grants and contributions presented in the final 2021-2022 Financial Reports is $40.5M and the operating result including capital grants and contributions of $65.6M was a surplus of $106.1M – a decrease of $2.7M.

The table below compares the draft 2021-2022 results with the final 2021-2022 results.

|

|

Draft 2021-2022 |

Final 2021-2022 |

Movement

$’000 |

|

Income from operations |

603,100 |

603,204 |

104 |

|

Expenditure from operations |

555,769 |

562,759 |

(6,990) |

|

Operating result for continuing operations (excluding capital grants and contributions) |

47,331 |

40,445 |

(6,886) |

|

Income from capital grants and contributions |

61,452 |

65,626 |

4,174 |

|

Net operating result (including capital grants and contributions) |

108,783 |

106,071 |

(2,712) |

Income from Operations

The following table reports income by category and is followed by explanations of the significant movements between draft and final results.

|

Income from Operations |

Draft 2021-2022 |

Final 2021-2022 |

Movement

$’000 |

|

Rates and Annual Charges |

365,780 |

365,780 |

- |

|

User Charges and Fees |

140,237 |

140,237 |

- |

|

Interest and Investment Revenue |

7,118 |

7,118 |

- |

|

Other Revenues |

20,765 |

20,765 |

- |

|

Grants and Contributions - Operating |

47,717 |

47,717 |

- |

|

Grants and Contributions - Capital |

61,452 |

65,626 |

4,174 |

|

Net gain from disposal of assets |

21,483 |

21,587 |

104 |

|

Total Income |

664,552 |

668,830 |

4,278 |

Grants and Contributions - Capital

The $4.2M increase is the recognition of found assets during the Community and Recreation Services (CRS) revaluation work undertaken during FY 2022.

Net gain from disposal of assets

The $0.1M increase relates to a minor adjustment to the fair value of a disposed asset.

Expenditure from Operations

The following table reports expenditure by category and is followed by explanations of the significant movements between draft and final results.

|

Expenditure from Operations |

Draft 2021-2022 |

Final 2021-2022 |

Movement

$’000 |

|

Employee benefits and on-costs |

162,831 |

162,831 |

- |

|

Materials and services |

165,542 |

165,542 |

- |

|

Borrowing costs |

14,588 |

14,588 |

- |

|

Depreciation, amortisation and impairment |

162,051 |

169,041 |

(6,990) |

|

Other expenses |

50,757 |

50,757 |

- |

|

Total Expenditure |

555,769 |

562,759 |

(6,990) |

Depreciation, amortisation and impairment

The $7.0M increase is attributable to revalued CRS, roads, drainage, water and sewer assets following the revaluation work undertaken during FY 2022.

Statement of Financial Position

The Statement of Financial Position details the value of what Council owns (“assets”) and what Council owes (“liabilities”).

Within these headings, “Current” means an amount that is due to be realised within the next 12 months whilst “Non-current” indicates an asset or liability that is longer term in nature.

The following table shows the changes in category on the Statement of Financial Position followed by explanations of the significant movements between draft and final results.

|

Statement of Financial Position |

Draft 30 June 2022 |

Final 30 June 2022 |

Movement

|

|

Assets |

|||

|

Current Assets |

306,700 |

306,699 |

(1) |

|

Non-Current Assets |

7,969,199 |

8,578,968 |

609,769 |

|

Total Assets |

8,275,899 |

8,885,667 |

609,768 |

|

Liabilities |

|

|

|

|

Current Liabilities |

192,882 |

190,633 |

2,249 |

|

Non-Current Liabilities |

370,667 |

372,921 |

(2,254) |

|

Total Liabilities |

563,549 |

563,554 |

(5) |

|

Net Assets |

|

|

|

|

Accumulated Surplus |

7,065,230 |

7,111,427 |

46,197 |

|

Revaluation Reserve |

647,120 |

1,210,686 |

563,566 |

|

Net Equity |

7,712,350 |

8,322,113 |

609,763 |

Non-current assets

The $609.8M increase in non-current assets is primarily made up of four adjustments.

· $469.4M increase in the value of Infrastructure, Property, Plant and Equipment as a result of revaluation activities and fair value adjustments.

· $132.7M in prior period adjustments rolled forward.

· $14.5M recognition of newly found assets.

· ($7.0M) attributable to increased depreciation charges.

Current and non-current liabilities

The $2.254M movement between current and non-current liabilities was a reallocation of contract liabilities.

Statement of Performance Measurement (Note G6)

Note G6 - Statement of Performance Measures, includes various indicators mandated by the Office of Local Government (OLG). The indicators provide a ‘snap-shot’ of financial performance and comparability between Councils. The “benchmark” figures for the indicators reported represent the OLG’s benchmarks.

The table below shows minor movements in the performance measures as a result of the amendments to the Financial Statements described above.

|

Local Government Industry Indicators

|

Draft 2022 |

Final 2022 |

OLG Benchmark |

2022 Result |

|

Operating Performance Ratio |

8.92% |

7.73% |

> 0.00% |

|

|

Own Source Operating Revenue Ratio |

83.02% |

82.49% |

> 60.00% |

|

|

Unrestricted Current Ratio |

1.13x |

1.8x |

> 1.50x |

|

|

Debt Service Cover Ratio |

3.98x |

3.98x |

> 2.00x |

|

|

Rates, Annual Charges, Interest Outstanding Percentage |

4.75% |

4.75% |

< 5.00% |

|

|

Cash Expense Cover Ratio |

7.02 months |

7.02 months |

> 3 months |

|

Operating Performance Ratio - measures how well Council contained operating expenditure within operating revenue. Council’s performance is above the benchmark.

Own Source Operating Revenue Ratio - measures Council’s fiscal flexibility and the degree of reliance on external funding sources such as operating grants and contributions. Council’s performance is satisfactory as it is above the benchmark.

Unrestricted Current Ratio – measures the adequacy of working capital and Council’s ability to satisfy obligations in the short term for the unrestricted activities of Council. Council’s performance is above the benchmark.

Debt Service Cover Ratio - measures the availability of operating cash to service debt including interest, principal and lease payments. Council’s performance is above the benchmark.

Rate and Annual Charges Outstanding Ratio - assesses the impact of uncollected rates and annual charges on Council’s liquidity and the adequacy of debt recovery efforts. Council’s performance is above the benchmark.

Cash Expense Cover Ratio - this liquidity ratio indicates the number of months a Council can continue paying for its immediate expenses without additional cash inflow. Council’s performance is above the benchmark.

Water Supply Authority (WSA) Financial Statements

Following is a comparison of the financial performance for Central Coast Council Water Supply Authority as presented in the Draft 2021-2022 Financial Statements on 27 September 2022 compared to the final Financial Statements for 2021-2022 attached to this report.

Operating Result

The operating deficit before capital grants and contributions presented in the draft 2021-2022 Financial Reports was ($6.2M) and the operating result including capital grants and contributions of $15.9M was a surplus of $9.7M.

The operating deficit before capital grants and contributions presented in the final 2021-2022 Financial Reports is ($10.2M) and the operating result including capital grants and contributions of $15.9M was a surplus of $5.8M – a decrease of $3.9M.

The table below compares the draft 2021-2022 results with the final 2021-2022 results.

|

|

Draft 2021-2022 |

Final 2021-2022 |

Movement

|

|

Income from operations |

166,003 |

166,003 |

- |

|

Expenditure from operations |

172,170 |

176,128 |

(3,958) |

|

Net operating result (excluding capital grants and contributions) |

(6,167) |

(10,125) |

(3,958) |

|

Income from capital grants and contributions |

15,879 |

15,879 |

- |

|

Net operating result (including capital grants and contributions) |

9,712 |

5,754 |

(3,958) |

Income from Operations

The following table reports income by category and is followed by explanations of the significant movements between draft and final results. There were no movements in income from operations.

|

Draft 2021-2022 |

Final 2021-2022 |

Movement

|

|

|

Annual Charges |

85,670 |

85,670 |

- |

|

User Charges and Fees |

78,136 |

78,136 |

- |

|

Interest and Investment Revenue |

1,959 |

1,959 |

- |

|

Other Revenues |

112 |

112 |

- |

|

Grants and Contributions - Operating |

117 |

117 |

- |

|

Grants and Contributions - Capital |

15,879 |

15,879 |

- |

|

Net gain from disposal of assets |

9 |

9 |

- |

|

Total Income |

181,882 |

181,882 |

- |

Expenditure from Operations

The following table reports expenditure by category and is followed by explanations of the significant movements between draft and final results.

|

Expenditure from Operations |

Draft 2021-2022 |

Final 2021-2022 |

Movement

|

|

Employee benefits and on-costs |

27,242 |

27,242 |

- |

|

Materials and services |

56,794 |

56,794 |

- |

|

Borrowing costs |

10,489 |

10,489 |

- |

|

Depreciation and amortisation |

74,543 |

78,501 |

(3,958) |

|

Other expenses |

3,102 |

3,102 |

- |

|

Total Expenditure |

172,170 |

176,128 |

(3,958)

|

Depreciation, amortisation and impairment

The $4.0M increase is attributable to revalued drainage, water and sewer assets following the revaluation work undertaken during FY 2022.

Statement of Financial Position

The following table shows the changes in category on the Statement of Financial Position followed by explanations of the significant movements between draft and final results.

|

Statement of Financial Position |

Draft 30 June 2022 |

Final 30 June 2022 |

Movement |

|

Assets |

|||

|

Current Assets |

108,975 |

108,970 |

(5) |

|

Non-Current Assets |

3,856,781 |

4,206,171 |

349,390 |

|

Total Assets |

3,965,756 |

4,315,141 |

349,385 |

|

Liabilities |

|

|

|

|

Current Liabilities |

68,289 |

68,289 |

- |

|

Non-Current Liabilities |

171,605 |

171,603 |

(2) |

|

Total Liabilities |

239,894 |

239,892 |

(2) |

|

Net Assets |

|

|

|

|

Retained Earnings |

3,467,318 |

3,448,758 |

(18,560) |

|

Revaluation Reserve |

258,544 |

626,491 |

367,947 |

|

Net Equity |

3,725,862 |

4,075,249 |

349,387 |

Non-current assets

The $349.4M increase in non-current assets is primarily made up of three adjustments.

· $243.9M increase in the value of Infrastructure, Property, Plant and Equipment as a result of revaluation activities and fair value adjustments.

· $109.4M in prior period adjustments rolled forward.

· ($3.9M) attributable to increased depreciation charges.

Annual Report

In accordance with the Local Government Act 1993, Council’s Annual Report 2021-22 was prepared and adopted by Council on 28 February 2023. As was noted in the Council report, the Audited Financial Statements would have usually been included in the Annual Report, however, the Office of Local Government had provided Council an extension for the financial statements. The Annual Report 2021-22 was published on Council’s website and financial information was disclosed in the Annual Report 2021-22 but was noted as being drawn from unaudited results and readers should be mindful that the financial information contained within it was subject to review and potential adjustment as part of the audit process. Included as part of the recommendations for this report is that the Annual Report 2021-22 published on the website now be amended to include the results of the Audited Financial Statements. This will mean that a revised version will be published on the website and readers should again be aware that if they have the previous version of the Annual Report 2021-22 that the figures may have changed.

It is recommended that upon the adoption of the 2021-2022 Central Coast Council Financial Reports, that they be included in Council’s 2021-2022 Annual Report, Council’s website be appropriately updated, and a copy be provided to the Minister for Local Government.

Consultation

All areas of Council contribute to the information contained within the Financial Reports.

Financial Considerations

At its meeting held 19 October 2020, Council resolved the following:

1108/20 That any motions put before Council for the remainder of this term of Council that have financial implications require the Chief Executive Officer to provide a report on how those additional costs will be met.

The following statement is provided in response to this resolution of Council.

These Financial Reports set out the financial position of Central Coast Council and Central Coast Council Water Supply Authority as at 30 June 2022 and the financial performance and cash flows for the reporting period 1 July 2021 to 30 June 2022. Comparatives for the statutory reporting period 1 July 2020 to 30 June 2021 (including any restated amounts) are included in accordance with requirements set down by the NSW Office of Local Government in line with accounting standards.

Council’s net operating result for the financial year ended 30 June 2022 is a surplus of $40.5M excluding Grants and Contributions for capital purposes. After adjusting for Capital Grants and Contributions, the net operating surplus was $106.1M.

Central Coast Council Water Supply Authority’s net operating result for the financial year ended 30 June 2022 is a deficit of ($10.1M) excluding Grants and Contributions for capital purposes. After adjusting for Capital Grants and Contributions, the net operating surplus was $5.8M.

The net assets for Central Coast Council as at 30 June 2022 total $8.3 billion.

The net assets for Central Coast Council Water Supply Authority as at 30 June 2022 total $4.1 billion.

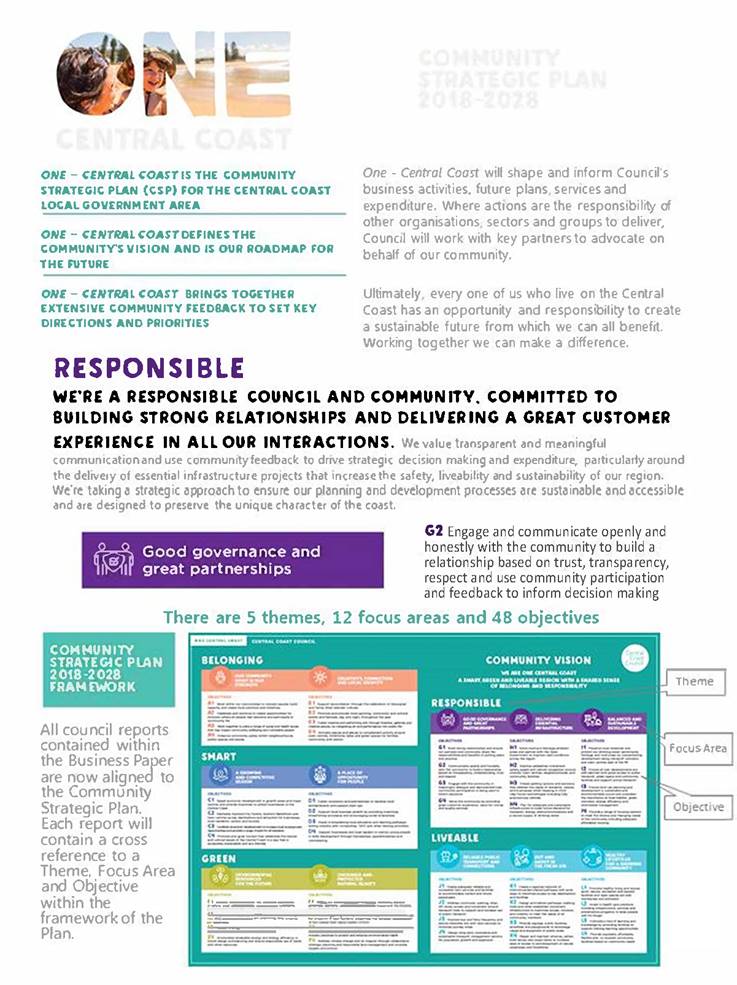

Link to Community Strategic Plan

Theme 4: Responsible

|

Goal G: Good governance and great partnerships |

|

R-G2: Engage and communicate openly and honestly with the community to build a relationship based on trust, transparency, respect and use community participation and feedback to inform decision making. |

Risk Management

Council has worked with the Audit Office of New South Wales to meet our legislative reporting requirements.

The Financial Reports are audited by the Audit Office of New South Wales who, amongst other things, form an opinion on the Financial Statements whether:

· The Council’s accounting records have been kept in accordance with the requirements of the Local Government Act 1993, Chapter 13, Part 3 Division 2; and

The Financial Statements:

· Have been prepared, in all material respects, in accordance with the requirements of this Division

· Are consistent with the Council’s accounting records

· Present fairly, in all material respects, the financial position of the Council as at 30 June 2022, and of its financial performance and its cash flows for the year then ended in accordance with Australian Accounting Standards

· All information relevant to the conduct of the audit has been obtained

· No material deficiencies in the accounting records or financial statements have come to light during the audit.

Options

It is a legislative requirement for Councils to adopt annual Financial Reports.

Critical Dates or Timeframes

In accordance with s.48 (2) of the LG Act, Council must present its 2021-2022 Consolidated Financial Reports to the community, and it is a legislative requirement for Councils to adopt annual Financial Reports.

Any person may make a submission to Council regarding the Financial Statements or with respect to the Auditor’s reports. All submissions must be in writing and will be referred to the NSW Audit Office, and Council can take such action as it considers appropriate. The closing date for submissions is Tuesday 7 March 2023.

|

1⇩ |

Annual Financial Statements - GPFS - SPFS - SS |

|

D15562605 |

|

2⇩ |

Annual Financial Statements - WSA |

|

D15562596 |

|

2.4 |

Presentation of 2021-2022 Financial Reports and related Auditor's Reports for Central Coast Council and Central Coast Council Water Supply Authority |

|

Attachment 1 |

Annual Financial Statements - GPFS - SPFS - SS |

|

Presentation of 2021-2022 Financial Reports and related Auditor's Reports for Central Coast Council and Central Coast Council Water Supply Authority |

|

|

Attachment 2 |

Annual Financial Statements - WSA |