Oath or Affirmation of Office

Councillors are reminded of their Oath or Affirmation of Office to undertake their duties in the best interests of the people of the Central Coast and Council and to faithfully and impartially carry out the functions, powers, authorities, and discretions vested in them under the Local Government Act 1993, or any other Act to the best of their ability and judgement. Councillors are also reminded of their obligations under the Code of Conduct to disclose and appropriately manage conflicts of interest.

Disclosures of Interest

Councillors are reminded of their obligation under Council’s Code of Conduct to declare any conflict of interest in a matter considered by Council.

Pecuniary interest: A Councillor who has a pecuniary interest in any matter with which the Council is concerned, and who is present at a meeting of the Council at which the matter is being considered, must disclose the nature of the interest to the meeting. The Councillor must not be present at, or in sight of, the meeting:

a) At any time during which the matter is being considered or discussed, or

b) At any time during which the Council is voting on any question in relation to the matter.

Non-Pecuniary conflict of interest: A Councillor who has a non-pecuniary conflict of interest in a matter, must disclose the relevant private interest in relation to the matter fully and on each occasion on which the non-pecuniary conflict of interest arises in relation to the matter.

Significant Non-Pecuniary conflict of interest: A Councillor who has a significant non-pecuniary conflict of interest in relation to a matter under consideration at a Council meeting, must manage the conflict of interest as if they had a pecuniary interest in the matter.

Non-Significant Non-Pecuniary interest: A Councillor who determines that they have a non-pecuniary conflict of interest in a matter that is not significant and does not require further action, when disclosing the interest it must also be explained why the conflict of interest is not significant and does not require further action in the circumstances.

Recording

In accordance with the NSW Privacy and Personal Information Protection Act 1998, you are advised that all discussion held during the Open Council meeting is recorded for the purpose of livestreaming the public meeting and verifying the minutes. This will include any public discussion involving a councillor, staff member or a member of the public.

Meeting Notice

The Ordinary Council Meeting

of Central Coast Council

will be held in the Central Coast Council Chambers,

2 Hely Street, Wyong

on Tuesday 25 February 2025 at 6.30pm,

for the transaction of the business listed below:

The Public Forum

will commence at 6.00pm, subject to any registered speaker/s to items listed on

this agenda.

Further

information and details on registration process: www.centralcoast.nsw.gov.au/council/meetings-and-minutes/council-meetings

1 Procedural Items

1.1 Disclosure of Interest................................................................................................................................ 7

1.2 Confirmation of Minutes of Previous Meeting................................................................................. 7

1.3 Items Resolved by Exception.................................................................................................................. 7

2 Reports

2.1 Monthly Finance Report December 2024.......................................................................................... 9

2.2 Monthly Finance Report January 2025............................................................................................. 23

2.3 Monthly Investment Report December 2024................................................................................. 36

2.4 Monthly Investment Report January 2025...................................................................................... 44

2.5 December 2024 (Q2) Quarterly Operational Plan and Budget Review.................................. 52

2.6 Central Coast Airport Master Plan for Adoption........................................................................... 62

2.7 Proposal to establish Committees of Council................................................................................ 78

2.8 W&S Delivery Plan Biannual Progress Report (Jul-Dec 2024)................................................... 85

2.9 Water and Sewer Backflow Prevention Policy................................................................................ 89

2.10 Rugby World Cup 2027 - Request for Proposal - Base Training Camp................................. 92

2.11 Australian Local Government Association (ALGA) National General Assembly 2025 - attendance and voting and Expression of Interest to host the 2027 Australian Local Government Women's Association (ALGWA) NSW Annual Conference.......................................................................... 100

2.12 Unlawful Camping in Parks and Reserves..................................................................................... 109

2.13 Submission - Cultural State Environmental Planning Policy: Explanation of Intended Effects exhibition................................................................................................................................................. 115

2.14 Voluntary Planning Agreement - Tuggerah Gateway Site....................................................... 119

2.15 Fraud and Corruption Prevention Policy....................................................................................... 124

2.16 Proposal to seek OLG Exemption to extend term of Audit, Risk and Improvement Chair 127

2.17 Classification of land acquired by Council - Behind Main Road Toukley & Adjoining Virginia Road Warnervale.............................................................................................................................................. 133

2.18 Consultation on Reforms to Council Meeting Practices........................................................... 138

2.19 Disclosure of Interest Returns – Councillors................................................................................. 141

2.20 Status Update on Active Council Resolutions.............................................................................. 144

2.21 Minutes and Recommendations of the Review Committee - Current Library Building - January and February 2025......................................................................................................................................... 146

2.22 Minutes of the Economic Development Committee - February 2025................................. 149

2.23 Fire Safety Inspection Report - 11-29 The Entrance Road, The Entrance........................... 151

2.24 Fire Safety Inspection Report - 6 Pine Tree Lane, Terrigal....................................................... 157

2.25 Community Support Grant Program November and December 2024................................ 161

3 Notices of Motion

3.1 Notice of Motion - Establishment of a Catchment to Coast Advisory Committee (CCAC) 166

3.2 Notice of Motion - Establishment of Advisory Committee re Mangrove Mountain Landfill.. 169

3.3 Notice of Motion - Council's Income Generating Assets......................................................... 171

3.4 Notice of Motion - Simplified Development Approval Pathway for Events....................... 173

3.5 Notice of Motion - Removal of the limit on Notice of Motions at each Council meeting 174

4 Questions with Notice

4.1 IPART Water Utility Satisfaction Survey Results.......................................................................... 176

4.2 Question with Notice - Update on Existing Gosford Library Building................................. 177

4.3 The Azzuro Blu Building at The Entrance....................................................................................... 178

David Farmer

Chief Executive Officer

|

Item No: 1.1 |

|

|

Title: Disclosure of Interest |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Recommendation

That Council now disclose any conflicts of interest in matters under consideration by Council at this meeting.

|

Item No: 1.2 |

|

|

Title: Confirmation of Minutes of Previous Meeting |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Reference: F2024/00015 - D16518615

That Council

confirms the minutes of the Ordinary Meeting of Council held on

10 December 2024 as read and a true record of the Meeting.

Summary

Confirmation of minutes of the Ordinary Meeting of Council held on 10 December 2024.

Nil

|

Item No: 1.3 |

|

|

Title: Items Resolved by Exception |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Reference: F2024/00015 - D16554152

|

Recommendation

That Council determines the items on Council’s Agenda that will be adopted without debate.

Summary

In accordance with Council’s Code of Meeting Practice, items that are dealt with by exception are items where the recommendations contained in the staff reports in the agenda are adopted without discussion. |

|

Item No: 2.1 |

|

|

Title: Monthly Finance Report December 2024 |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Reference: F2020/03205 - D16589334

Author: Garry Teesson, Section Manager Financial Planning and Business Support

Manager: Emma Galea, Chief Financial Officer

Executive: Marissa Racomelara, Director Corporate Services

That Council receives the Monthly Financial Report – December 2024

|

Report purpose

To present to Council the monthly financial report for December 2024.

Executive Summary

For 2024-25 FY Council has budgeted, on a consolidated basis, an adopted operating surplus before capital income of $17.3M (Original Budget $10.7M). As at 31 December 2024, Council has an operating surplus of $19.4M, compared to a YTD budgeted operating surplus of $3.7M.

The budgeted net operating position will fluctuate throughout the financial year, reflecting income and expenditure timing. The YTD variance of $15.7M represents 2% of Council’s gross annual operating expenditure budget of $779M. It is noted that $7M of the favourable variance relates to the Water and Sewer Fund, with the remaining $8.7M relating to General Fund including Drainage and Domestic Waste.

As at the end of the reporting period, there are no concerns regarding Council’s performance against the adopted budget. Based on financial performance as at the end of the reporting period, Council is tracking to achieve a better operating result than budgeted.

As part of Council’s financial management framework, actual results for income and expenditure, against the amounts estimated for the reporting period, are monitored monthly. Reasons for significant variations, as well as any mitigation actions required are identified. Any required budget changes are submitted to Council as part of the legislated Quarterly Budget Review process. |

Background

The monthly financial report has been prepared in accordance with the requirements of the Local Government Act 1993, the ‘Local Government (General) Regulation 2021’, and the relevant accounting and reporting requirements of the Office of Local Government Code of Accounting Practice and Financial Reporting and Australian Accounting Standards.

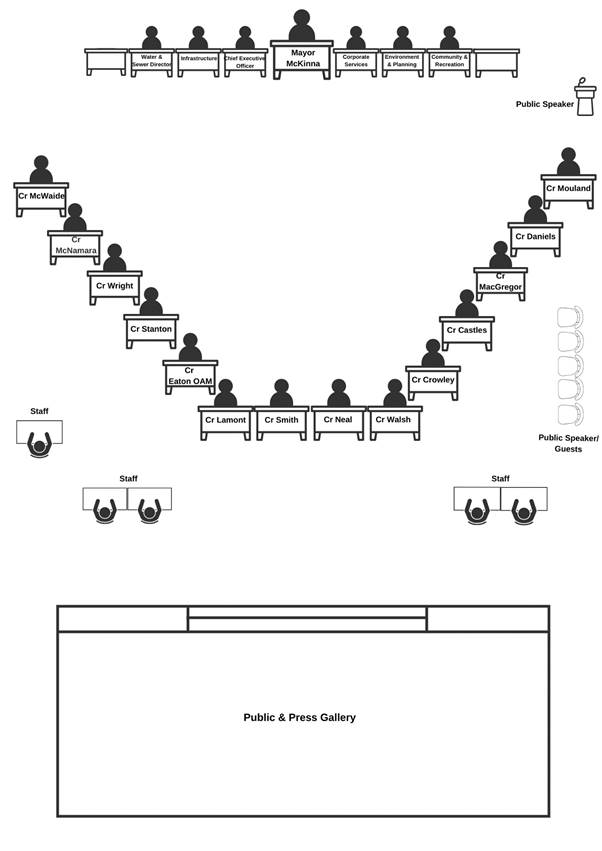

Report

Consolidated Operating Statement

As at 31 December 2024, Council has a consolidated net operating surplus of $19.4M, before capital income, which is favourable to YTD budget by $15.7M. The overall variance is predominantly driven by a YTD favourable variance in operating income, being an overall favourable YTD variance of $11.5M (1.5% of full year budget) of operating income and a YTD favourable variance in operating expenses against budget of $4.2M (0.5% of full year budget)

The net operating surplus including capital income is $81.9M which is favourable to YTD budget by $54.3M.

Variances are summarised and detailed below.

It is noted that, where relevant, budget adjustments to address these variances have been included in the Q2 Quarterly Budget Review (Q2 Review) that is included as a separate item in this business paper. Proposed changes include permanent full year forecast changes, re-alignment of budget timing with expected trends, and changes to reflect grants and contributions not previously included in the budget. Ongoing monitoring will continue and if required further adjustments will be proposed in the Quarter 3 review.

Table 1 – Consolidated (all Funds) Operating Statement December 2024

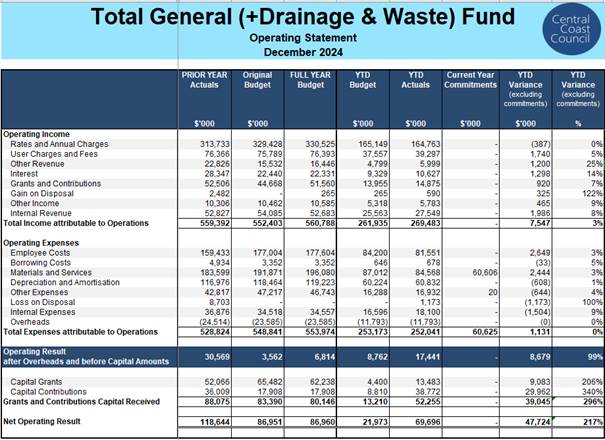

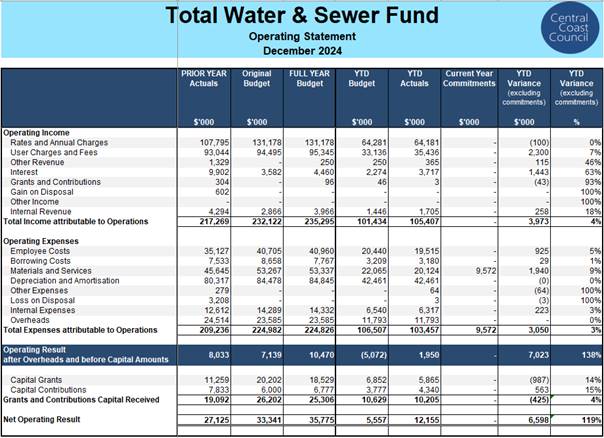

Variance analysis on the consolidated operating result is as follows:

Operating Revenue

Rates and Annual Charges

$0.5M Unfavourable to YTD budget.

· This variance relates to a combination of timing of income recognition against budget and also a permanent favourable variance to budget in General Rates and Domestic Waste revenue. The relevant proposed budget adjustments are included in the Q2 Review.

User Fees and Charges

$4.0M Favourable to YTD budget. Main variances include:

· $2.3M favourable Water and Sewer charges due to dry weather driving higher water usage. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.5M favourable in Holiday Park fees aligned with favourable activity. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.3M favourable in Waste Management fees relating to higher tipping activities (partly offset by operating expenses). Income is subject to external factors and is being monitored at this stage.

· $0.3M favourable in Development regulatory fees with slightly higher than forecast activity (partly recognised in Q2 review and being closely monitored).

· $0.2M favourable in Leisure Facility fees driven by increased patronage. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.2M favourable predominantly relating to education and care fees driven by higher than forecast utilisation of Council services. The relevant proposed budget adjustments are included in the Q2 Review.

· Balance is made up of variances across various operations.

Other Revenue

$1.3M Favourable to YTD budget.

· $0.5M favourable in unrealised gain on investments, floating rate notes and bonds. This income item is subject to volatility as it is driven by external market forces. Accordingly, the budget is updated each quarter based on actual unrealised gains recorded at that point in time. This approach is applied to minimise the risk of significant adverse budget impacts in the event of a major market downturn. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.4M favourable as a result of the sale of biodiversity credits. The relevant proposed budget adjustments are included in the Q2 Review.

· Balance is made up of variances across various operations.

Interest

$2.7M Favourable to YTD budget.

· Favourable variance from the favourable interest rate environment, hence receiving more interest on investments than budgeted. The relevant proposed budget adjustments are included in the Q2 Review.

Operating Grants and Contributions

$0.9M Favourable to YTD budget.

· $1.0M favourable driven by the Libraries Per Capita grant being received earlier than budgeted.

· Further grant income and associated expenditure across various operations has been recognised or re-aligned with delivery through the Q2 review.

Gain on Disposal

$0.3M Favourable to YTD budget.

· $0.3M favourable from disposals of plant and equipment through the programmed change overs.

Other Income

$0.5M Favourable to YTD budget.

· $0.5M favourable commercial lease income partly received in advance (timing difference).

Internal revenue

$2.2M Favourable to YTD budget

· $1.7M favourable due to internal tipping activities higher than budgeted for the first 6 months of the year predominantly in Roads Construction and Maintenance. Increased income is partly offset by increased internal operating expense and increased waste levies. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.8M favourable in relation to the internal sealing program running ahead of schedule.

Operating Expenses

Employee Costs

$3.6M Favourable to YTD budget.

· $3.1M of the favourable variance relates to staff vacancies trending higher than the budgeted vacancy rate. The remaining minor variance to other employee costs including superannuation and movement in leave provisions.

Materials and Services

$4.4M Favourable to YTD budget. Variances are mainly timing in nature. A further review has been undertaken as part of Q2 to ensure that budgeted amounts remain aligned with service levels to be delivered. Main variances include:

· $2.6M favourable in Governance Risk and Legal relating to timing of election expense payments against budget.

· $1.9M favourable across the Water & Sewer fund. Partly related to timing of project delivery and partly to reduced main breaks. The relevant proposed budget adjustments are included in the Q2 Review.

· $1.1M favourable in Community and Culture predominantly related to the timing of delivery and invoicing of events, projects, and contracts. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.9M favourable in Environmental Management project costs predominantly relating to timing of delivery. A review has been completed as part of Q2 with adjustments to budgets where necessary.

· $0.8M favourable in Commercial Property and Business Enterprise relating to timing differences in delivery and invoicing.

· $0.4M favourable in Waste Management (timing of contract payments)

· $4.9M unfavourable in Information Technology (timing of contract payments)

· Balance is made up of variances to YTD Budget across various operations, of under $0.4M individually.

Depreciation

$0.6M Unfavourable to YTD budget.

· This variance relates to the timing of completion and subsequent capitalisation of projects and the recognition of donated assets. The relevant proposed budget adjustments are included in the Q2 Review, with ongoing monitoring to continue).

Other Expenses

$0.7M Unfavourable to YTD budget.

· Increased EPA levy in line with increased tipping revenue as at the end of the reporting period. The full year forecast for tipping revenue and the associated EPA Levy is being reflected in the Q2 review.

Loss on Disposal

$1.2M Unfavourable to YTD budget.

· Variance due to asset values having residual values at time of disposal due to earlier than anticipated infrastructure replacement.

Internal expenses

$1.3M Unfavourable to YTD budget.

· Predominantly related to increased internal tipping and plant hire activity in relation to the delivery of externally funded roads maintenance programs. Internal expenses are offset by internal income. The relevant proposed budget adjustments are included in the Q2 Review.

Capital Income

Capital Grants

$8.1M Favourable to YTD budget. Timing differences associated with the recognition of income with capital delivery and payment milestones.

Budget timing has been reviewed as part of Q2 review to refine in alignment with the revised capital works delivery program.

$30.5M Favourable to YTD budget.

· Predominantly driven by the recognition of donated assets. Budget adjustments are included in future quarterly reviews as assets are recognised.

This variance is consistent with the nature of forecasting the exact timing of these external activities.

Financial Performance by Fund

The following Tables summarise the financial performance for the reporting period by Fund.

Table 2 – General (including Drainage and Waste) Fund Operating Statement - December 2024

Table 3 – Water and Sewer Fund Operating Statement - December 2024

Financial Performance Benchmarks

Below is a summary of Council’s performance, on a consolidated basis against main industry financial performance benchmarks set by the Office of Local Government.

Table 4 – Financial Performance Benchmarks - December 2024

|

Financial Performance Ratio |

Industry Benchmark |

Full year Forecast |

Ratio – YTD Actuals |

|

|

Operating Performance Ratio |

> 0% |

1.47% |

5.6% |

P |

|

Own Source operating Revenue Ratio |

> 60% |

81.57% |

80.9% |

P |

|

Unrestricted Current Ratio |

>1.5x |

2.57x |

4.6x |

P |

|

Cash Expense Cover Ratio |

> 3 months |

3.44 months |

4.1 months |

P |

|

Buildings and Infrastructure Renewals Ratio |

100% |

138% |

124.9% |

|

|

Infrastructure Maintenance Ratio |

100% |

n/a |

46% |

|

As at the end of the December 2024, on a consolidated basis, Council exceeded the mandated benchmark for the operating performance ratio, achieving 5.6%.

Council has also performed favourably against the unrestricted current ratio, achieving 4.6x against a benchmark of >1.5x. This ratio considers all current assets and liabilities, including cash.

Council maintained positive performance regarding the cash expense cover. Council is in a strong liquidity position.

The infrastructure ratios are monitored each month and are based on a point in time. The quoted performance is indicative of trend, with actual performance being formally measured on an annual basis. The Infrastructure Renewal Ratio is based on the actual renewal expenditure as at the end of the reporting period, compared to the depreciation over the same period. The Asset Maintenance Ratio is calculated based on actual maintenance as at the end of the reporting period compared to the required maintenance estimated over the same reporting period. Annual performance in regard to these ratios is included in the Special Schedules in the annual Financial Statements, noting that the infrastructure section within the Schedules does not form part of the NSW Audit Office audit.

Council is currently renewing its assets at a faster rate than the annual depreciation, therefore exceeding the 100% renewal benchmark. This reflects Council’s focus on addressing the backlog of assets in less than satisfactory condition. Further, when assessing the most cost-effective intervention, a renewal approach maybe chosen over a maintenance approach. This results in increased renewal and reduces reactive maintenance, and consequently a temporary lower than benchmark asset maintenance ratio.

Noting the volatility in the timing of asset renewal and maintenance, performance as at the end of a reporting period, is an indication only of Council’s likely performance against the benchmark for the year. To further enhance the reliability of these measures, a cross unit project is currently underway to ensure that all maintenance and renewal activities are appropriately captured and accounted for. The required maintenance will be subject to ongoing review within the context of the level of renewal being undertaken, and if required, will be adjusted on an annual basis.

Cash and Investments

Details on cash and investments as at 31 December 2024 are included in the Monthly Investment Report December 2024.

Loans

As at 31 December 2024 Council has borrowings totalling $201.4M, across all Funds, and including the remaining Emergency Loan that is due to be fully paid in November 2025.

The below Table summarises outstanding loan balances by Fund.

Table 5 – Outstanding loan borrowings by fund - December 2024

|

Fund |

General Fund

($’000) |

Drainage Fund

($’000) |

General Fund Consolidated with Drainage Fund ($’000) |

Water and Sewer Fund

($’000) |

|

External loans – current |

4,390 |

581 |

4,971 |

15,181 |

|

External loans - noncurrent (excluding emergency loan) |

9,005 |

5,997 |

15,002 |

129,840 |

|

Emergency loan |

36,389 |

0 |

36,389 |

0 |

|

Total external loans |

49,784 |

6,578 |

56,362 |

145,021 |

Current loans refer to loans payable this financial year, while non-current loans are those payable in future financial years. The table relates to external loans only. It is noted there are several internal loans between Funds.

Water, Sewer, and Drainage Fund Debt

$145M of the $201.4M total debt relates to the Water and Sewer Fund and is associated with long life water and sewer infrastructure assets. Borrowing for infrastructure assets that benefit multiple generations is appropriate, and is good practice, to achieve intergenerational equity. The Water and Sewer fund loan balance includes $30M drawn down recently on a borrowing facility to fund the Mardi Water Treatment Plant major upgrade. This is a major multi-year project costing $82.5m. There is a further $20m to be drawn down. Interest costs associated with these loans are funded through the Independent Pricing and Regulatory Tribunal (IPART) pricing determination for Water and Sewer services.

$6.6M of the total debt relates to the Drainage Fund. This will become General Fund debt from 2026/27.

General Fund Debt

In 2020 Council obtained Emergency Loans totalling $150M. These loans were required to finance Council’s working capital, cash reserves, maturing debt facilities and capital expenditure.

In December 2023, the $100M Emergency Loan was settled and repaid in full, extinguishing the requirement to refinance any amount. This left the $50M Emergency due to be refinanced or extinguished in November 2025, with the balance as at the reporting period being $36.4M.

Council is setting aside $1.4M each month in an internal restriction to be able to repay the Emergency Loan in November 2025 without the need to refinance any part of the loan, and without impacting on unrestricted cash at time of payment. The interest rates environment will be monitored and the timing and amount of any repayment or extinguishment of the loan will be optimised accordingly.

Excluding the outstanding emergency loan of $36.4M, General Fund, excluding Drainage, has debt of $13.4M, which is a relatively low level of debt considering the size of this Council.

Repayment of Debt

The various loans were mostly obtained over the past 20 years and except for the Emergency Loan, were used to fund specific major capital works projects, or capital programs where borrowing provided a cost-effective method of funding.

Older loans have previously been reviewed and refinanced where it was financially prudent to do so. In the last 12 months another review has been undertaken to assess the cost effectiveness of repaying General Fund loans. The review concluded that while Council has sufficient cash to pay the loans down, it is not cost effective due to the significant break costs that would be incurred.

Loan borrowings are made in accordance with Council’s Investments Management and Borrowing Policy that can be found at investments-management-and-borrowings-policy-adopted-23-july-2024.pdf

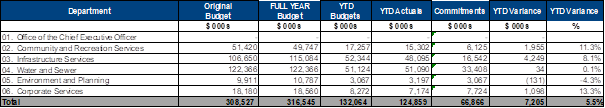

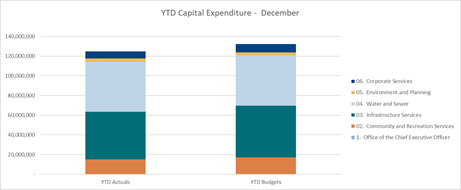

Capital Works

As at 31 December 2024 capital expenditure is $124.9M against a YTD budget of $132.1M for the same period, and a 2024-25 FY budget of $316.5M. Commitments (approved purchase orders to external suppliers) of $66.9M have been raised for delivery this year.

The current expenditure against budget indicates that delivery of works is trending slightly behind of anticipated timing, noting that delivery of works will accelerate in the second half of the financial year. Timing of the delivery of works is impacted by a number of factors including weather conditions, availability of suppliers, and any required approval processes.

A number of budget and timing adjustments relating to capital works are included in the Q2 review, and subject to Council adoption, will be reflected in the reported budgeted amounts in future monthly reports.

Table 6 – Capital Expenditure - December 2024

Figure 1 – Capital Expenditure by Directorate

Figure 2 – Capital Expenditure by Funding Source

Stakeholder Engagement

The preparation of the December 2024 monthly financial report included consultation with business units across Council to identify the reasons and mitigation strategies for significant variances to budget.

Financial Considerations

Financial Year (FY) Implications

The proposal has cost and revenue implications for the current FY only.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes funding for this proposal.

This report presents the financial position of Council as at 31 December 2024. Variations from budgeted amounts are detailed and an explanation provided. To date, there are no concerns regarding Council’s financial performance for the remainder of the financial year.

Link to Community Strategic Plan

Theme 4: Responsible

|

Goal G: Good governance and great partnerships |

|

R-G3: Provide leadership that is transparent and accountable, makes decisions in the best interest of the community, ensures Council is financially sustainable and adheres to a strong audit process. |

|

|

Risk Management

Council’s

financial management framework includes the monthly review and reporting of

significant variances to budget. This ensures that any issues are identified

and rectified in a timely manner, with any necessary adjustments being captured

in the appropriate Quarterly Budget Review.

This process mitigates the risk of Council’s financial performance deviating from the adopted budget and ultimately altering the trajectory of Council’s Long Term Financial Plan.

Critical Dates or Timeframes

Council receives monthly financial reports to ensure that Council is kept up to date with Council’s financial performance.

Nil

|

Item No: 2.2 |

|

|

Title: Monthly Finance Report January 2025 |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Reference: F2025/00016 - D16658879

Author: Garry Teesson, Section Manager Financial Planning and Business Support

Manager: Emma Galea, Chief Financial Officer

Executive: Marissa Racomelara, Director Corporate Services

That Council receives the Monthly Financial Report – January 2025

|

Report purpose

To present to Council the monthly financial report for January 2025.

Executive Summary

For 2024-25 FY Council has budgeted, on a consolidated basis, an adopted operating surplus before capital income of $17.3M (Original Budget $10.7M). As at 31 January 2025, Council has an operating surplus of $18.8M, compared to a YTD budgeted operating surplus of $4.2M.

The budgeted net operating position will fluctuate throughout the financial year, reflecting income and expenditure timing. This YTD operating surplus variance of $14.6M represents 2% of Council’s gross annual operating expenditure budget of $779M.

As at the end of the reporting period, there are no concerns regarding Council’s performance against the adopted budget. Based on financial performance as at the end of the reporting period, Council is tracking to achieve a better operating result than budgeted.

As part of Council’s financial management framework, actual results for income and expenditure, against the amounts estimated for the reporting period, are monitored monthly. Reasons for significant variations, as well as any mitigation actions required are identified. Any required budget changes are submitted to Council as part of the legislated Quarterly Budget Review process. |

Background

The monthly financial report has been prepared in accordance with the requirements of the Local Government Act 1993, the ‘Local Government (General) Regulation 2021’, and the relevant accounting and reporting requirements of the Office of Local Government prescribed Code of Accounting Practice and Financial Reporting and Australian Accounting Standards.

Report

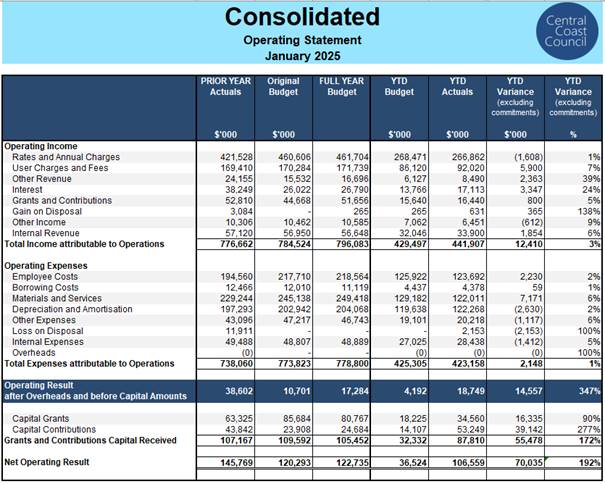

Consolidated Operating Statement

As at 31 January 2025, Council has a consolidated net operating surplus of $18.8M, before capital income, which is favourable to YTD budget by $14.6M. The overall variance is predominantly driven by a YTD favourable variance in operating income, being an overall favourable YTD variance of $12.4M (1.6% of full year budget) of operating income and a YTD favourable variance in operating expenses against budget of $2.2M (0.3% of full year budget).

The net operating surplus including capital income is $106.6M which is favourable to YTD budget by $70.0M.

Variances are summarised and detailed below.

It is noted that, where relevant, budget adjustments to address these variances have been included in the Q2 Quarterly Budget Review (Q2 Review) which is included as a separate item in this business paper. Proposed changes include permanent full year forecast changes, re-alignment of budget timing with expected trends, and changes to reflect grants and contributions not previously included in the budget. Ongoing monitoring will continue and if required further adjustments will be proposed in the Quarter 3 review.

Table 1 – Consolidated (all Funds) Operating Statement January 2025

Variance analysis on the consolidated operating result is as follows:

Operating Revenue

Rates and Annual Charges

$1.6M Unfavourable to YTD budget.

· This variance predominantly relates to budget phasing, which is being adjusted in Q2 Review.

User Fees and Charges

$5.9M Favourable to YTD budget.

· $2.2M favourable Water and Sewer charges due to dry weather driving higher water usage. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.8M favourable for externally funded Road Maintenance works.

· $0.6M favourable in Holiday Park fees aligned with favourable activity. The relevant proposed budget adjustments are included in the Q2 Review.

· $1.4M favourable in Waste Management fees relating to higher tipping activities (partly offset by operating expenses). Income is subject to external factors and is being monitored at this stage.

· $0.2M favourable in Development regulatory fees with slightly higher than forecast activity (partly recognised in Q2 review and being closely monitored).

· $0.4M favourable in Leisure Facility fees driven by increased patronage. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.1M favourable in education and care fees driven by higher than forecast utilisation of Council services. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.2M favourable in property certificates. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.2M unfavourable in across various Compliance and Inspection fees.

· Balance is made up of variances across various operations.

Other Revenue

$2.4M Favourable to YTD budget.

· $0.7M favourable in unrealised gain on investments, floating rate notes and bonds. This income item is subject to volatility as it is driven by external market forces. Accordingly, the budget is updated each quarter based on actual unrealised gains recorded at that point in time. This approach is applied to minimise the risk of significant adverse budget impacts in the event of a major market downturn. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.7M favourable as a result of the sale of biodiversity credits. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.4M favourable in Community Event and the associated sales and sponsorship revenue.

· Balance is made up of variances across various operations.

Interest

$3.3M Favourable to YTD budget.

· Favourable variance from the favourable interest rate environment, that is: receiving more interest on investments than budgeted. The relevant proposed budget adjustments are included in the Q2 Review.

Operating Grants and Contributions

$0.8M Favourable to YTD budget.

· $1.0M favourable driven by the Libraries Per Capita grant being received earlier than budgeted.

· Further grant income and associated expenditure across various operations has been recognised or re-aligned with delivery through the Q2 review.

Gain on Disposal

$0.4M Favourable to YTD budget.

· $0.4M favourable from disposals of plant and equipment through the programmed change overs.

Other Income

$0.6M Unfavourable to YTD budget.

· $0.6M Unfavourable predominantly due to the timing of income recognition for commercial leases and community facilities (timing difference only and on track for full year).

Internal revenue

$1.9M Favourable to YTD budget.

· $1.4M favourable due to internal tipping activities higher than budgeted for the first 6 months of the year predominantly in Roads Construction and Maintenance. Increased income is offset by increased internal operating expense and increased waste levies. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.9M favourable in relation to the internal sealing program running ahead of schedule.

Operating Expenses

Employee Costs

$2.2M Favourable to YTD budget.

· $2.2M favourable predominantly due to staff vacancies trending higher than budget, offset by unfavourable variances in other employee costs.

Materials and Services

$7.2M Favourable to YTD budget. Variances are mainly timing in nature. A review has been undertaken as part of Q2 review to ensure that budgeted amounts remain aligned with service levels to be delivered. Main variances include:

· $2.7M favourable in Governance Risk and Legal predominantly relating to timing of election expense payments against budget

· $1.9M favourable in Water & Sewer. Partly related to timing of project delivery and partly to reduced main breaks. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.2M favourable in Streetlighting costs. The relevant proposed budget adjustments are included in the Q2 Review.

· $5.0M unfavourable in Information Technology (timing of contract payments).

· $1.3M favourable in Waste Management (timing of contract payments).

· $1.7M favourable in Roads Maintenance delivery (timing of contract payments).

· $0.7M favourable in Community and Culture due to timing of program delivery and invoicing.

· $0.7M favourable in Customer Marketing and Economic Development due to timing of program delivery and invoicing.

· $1.2M favourable in Environmental Management due to timing of program delivery and invoicing. The relevant proposed budget adjustments are included in the Q2 Review.

· $0.7M favourable in Commercial Property and Holiday Parks (timing of contract payments).

· Balance is made up of variances across various operations, of under $0.5M individually.

Depreciation

$2.6M Unfavourable to YTD budget.

· This variance relates to the timing of completion and subsequent capitalisation of projects and the recognition of donated assets. The relevant proposed budget adjustments are included in the Q2 Review, with ongoing monitoring to continue.

Other Expenses

$1.1M Unfavourable to YTD budget.

· Increased EPA levy in line with increased tipping revenue as at the end of the reporting period. The full year forecast for tipping revenue and the associated EPA Levy is being reflected in the Q2 review.

Loss on Disposal

$2.2M Unfavourable to YTD budget.

· Variance due to asset values having residual values at time of disposal due to earlier than anticipated infrastructure replacement.

Internal expenses

$1.4M Unfavourable to YTD budget.

· Predominantly related to increased internal tipping and plant hire activity in relation to the delivery of externally funded roads maintenance programs. Internal expenses are offset by internal income. The relevant proposed budget adjustments are included in the Q2 Review.

Capital Income

Capital Grants

$16.3M Favourable to YTD budget. Timing differences associated with the recognition of income with capital delivery and payment milestones.

Budget timing has been reviewed as part of Q2 review to refine in alignment with the revised capital works delivery program.

Capital Contributions

$39.1M Favourable to YTD budget.

· Predominantly driven by the recognition of donated assets and some favourable activity in Water and Sewer developer contributions. Budget adjustments are included in future quarterly reviews as assets are recognised.

This variance is consistent with the nature of forecasting the exact timing of these external activities.

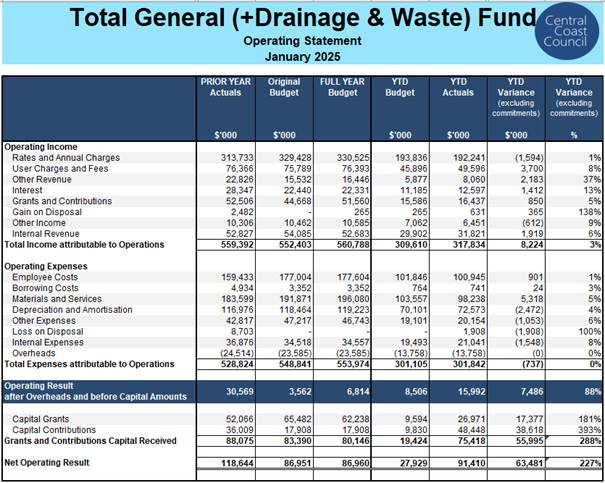

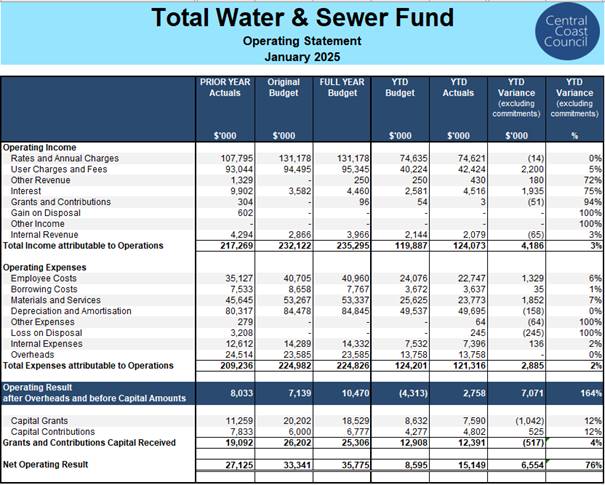

Financial Performance by Fund

The following Tables summarise the financial performance for the reporting period by Fund.

Table 2 – General (including Drainage and Waste) Fund Operating Statement - January 2025

Table 3 – Water and Sewer Fund Operating Statement - January 2025

Financial Performance Benchmarks

Below is a summary of Council’s performance, on a consolidated basis against main industry financial performance benchmarks set by the Office of Local Government.

Table 4 – Financial Performance Benchmarks – January 2025

|

Financial Performance Ratio |

Industry Benchmark |

Full year Forecast |

Ratio – YTD Actuals |

|

|

Operating Performance Ratio |

> 0% |

1.47% |

5.0% |

P |

|

Own Source operating Revenue Ratio |

> 60% |

81.57% |

78.8% |

P |

|

Unrestricted Current Ratio |

>1.5x |

2.57x |

4.8x |

P |

|

Cash Expense Cover Ratio |

> 3 months |

3.44 months |

4.5 months |

P |

|

Buildings and Infrastructure Renewals Ratio |

100% |

138% |

117% |

|

|

Infrastructure Maintenance Ratio |

100% |

n/a |

45.2% |

|

As at the end of the January 2025, on a consolidated basis, Council exceeded the mandated benchmark for the operating performance ratio, achieving 5.0%.

Council has also performed favourably against the unrestricted current ratio, achieving 4.8x against a benchmark of >1.5x. This ratio considers all current assets and liabilities, including cash.

Council maintained positive performance regarding the cash expense cover. Council is in a strong liquidity position.

The infrastructure ratios are monitored each month and are based on a point in time. The quoted performance is indicative of trend, with actual performance being formally measured on an annual basis. The Infrastructure Renewal Ratio is based on the actual renewal expenditure as at the end of the reporting period, compared to the depreciation over the same period. The Asset Maintenance Ratio is calculated based on actual maintenance as at the end of the reporting period compared to the required maintenance estimated over the same reporting period. Annual performance in regard to these ratios is included in the Special Schedules in the annual Financial Statements, noting that the infrastructure section within the Schedules does not form part of the NSW Audit Office audit.

Council is currently renewing its assets at a faster rate than the annual depreciation, therefore exceeding the 100% renewal benchmark. This reflects Council’s focus on addressing the backlog of assets in less than satisfactory condition. Further, when assessing the most cost-effective intervention, a renewal approach may be chosen over a maintenance approach. This results in increased renewal and reduces reactive maintenance, and consequently a temporary lower than benchmark asset maintenance ratio.

Noting the volatility in the timing of asset renewal and maintenance, performance as at the end of a reporting period, is an indication only of Council’s likely performance against the benchmark for the year. To further enhance the reliability of these measures, a cross unit project is currently underway to ensure that all maintenance and renewal activities are appropriately captured and accounted for. The required maintenance will be subject to ongoing review within the context of the level of renewal being undertaken, and if required, will be adjusted on an annual basis.

Cash and Investments

Details on cash and investments as at 31 January 2025 are included in the Monthly Investment Report January 2025.

Loans

As at 31 January 2025 Council has borrowings totalling $211.1M, across all Funds and including the remaining Emergency Loan that is due to be fully paid in November 2025.

Table 5 – Outstanding loan borrowings by fund – January 2025

|

Fund |

General Fund

($’000) |

Drainage Fund

($’000) |

General Fund Consolidated with Drainage Fund ($’000) |

Water and Sewer Fund

($’000) |

|

External loans – current |

4,390 |

581 |

4,971 |

15,736 |

|

External loans - non current (excluding emergency loan) |

9,005 |

5,997 |

15,002 |

139,284 |

|

Emergency loan |

36,111 |

0 |

36,111 |

0 |

|

Total external loans |

49,506 |

6,578 |

56,084 |

155,020 |

Current loans refer to loans payable this financial year, while non-current loans are those payable in future financial years.

Borrowing for infrastructure assets such as sewer, water and drainage assets, that benefit multiple generations is appropriate, and is good practice, to achieve intergenerational equity. During January 2025, $10M was drawn down on the borrowing facility to fund the Mardi Water Treatment Plant major upgrade.

General Fund Debt

After the extinguishment of one of the emergency loans taken out in 2020, Council has the second emergency loan due to be refinanced or extinguished in November 2025.

During the month of January 2025, a repayment of $0.3M was made against the emergency loan, reducing the balance from $36.4M reported as at the end of December 2024 to $36.1M as at the end of this reporting period.

Council is setting aside $1.4M each month in an internal restriction to be able to repay the Emergency Loan in November 2025 without the need to refinance any part of the loan, and without impacting on unrestricted cash at time of payment.

Excluding the outstanding emergency loan, Council has a relatively low level of debt considering the size of this Council.

Capital Works

As at 31 January 2025 capital expenditure is $138.3M against a YTD budget of $153.8M for the same period, and a 2024-25 FY budget of $316.5M. Commitments (approved purchase orders to external suppliers) of $65.5M have been raised for delivery this year.

The current expenditure against budget indicates that delivery of works is trending slightly behind of anticipated timing, noting that delivery of works will accelerate in the second half of the financial year. Delivery of works is impacted by a number of factors including weather conditions, availability of suppliers, and any required approval processes.

A number of budget and timing adjustments relating to capital works are included in the Q2 review, and subject to Council adoption, will be reflected in the reported budgeted amounts in future monthly reports.

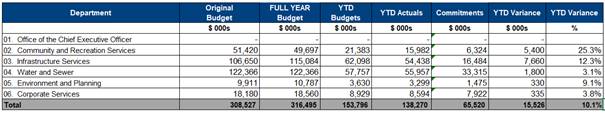

Table 5 – Capital Expenditure – January 2025

Figure 1 – Capital Expenditure by Directorate

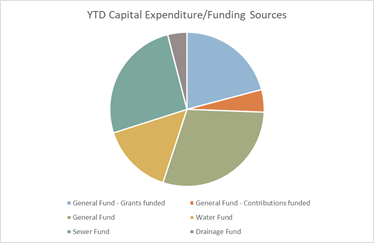

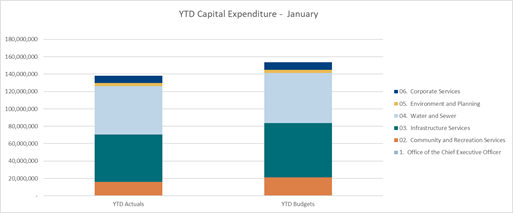

Figure 2 – Capital Expenditure by Funding Source

Stakeholder Engagement

The preparation of the January 2025 monthly financial report included consultation with business units across Council to identify the reasons and mitigation strategies for significant variances to budget.

Financial Considerations

Financial Year (FY) Implications.

The proposal has cost and revenue implications for the current FY only.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes funding for this proposal.

This report presents the financial position of Council as at 31 January 2025. Variations from budgeted amounts are detailed and an explanation provided. To date, there are no concerns regarding Council’s financial performance for the remainder of the financial year.

Link to Community Strategic Plan

Theme 4: Responsible

|

Goal E: Environmental resources for the future |

|

R-G3: Provide leadership that is transparent and accountable, makes decisions in the best interest of the community, ensures Council is financially sustainable and adheres to a strong audit process. |

Risk Management

Council’s

financial management framework includes the monthly review and reporting of

significant variances to budget. This ensures that any issues are identified

and rectified in a timely manner, with any necessary adjustments being captured

in the appropriate Quarterly Budget Review.

This process mitigates the risk of Council’s financial performance deviating from the adopted budget and ultimately altering the trajectory of Council’s Long Term Financial Plan.

Critical Dates or Timeframes

Council receives monthly financial reports to ensure that Council is kept up to date with Council’s financial performance.

|

Item No: 2.3 |

|

|

Title: Monthly Investment Report December 2024 |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Reference: F2025/00016 - D16659445

Author: Michelle Best, Section Manager Financial Accounting and Assets

Manager: Emma Galea, Chief Financial Officer

Executive: Marissa Racomelara, Director Corporate Services

That Council:

1 Notes the Investment Report for December 2024.

2 Notes that the required unrestricted funds available in the General Fund offsets the December 2024 unrestricted funds deficit in the Drainage Fund.

|

Report purpose

To present the monthly Investment Report for December 2024.

Executive Summary

This report provides details of Council’s investment portfolio and performance as at 31 December 2024. |

Background

Clause 212 of the Local Government (General) Regulations 2021 stipulates:

(1) The Responsible Accounting Officer of a Council

a must provide the council with a written report (setting out details of all money that the council has invested under section 625 of the Act) to be presented

i. if only one ordinary meeting of the council is held in a month, at that meeting, or

ii. if more than one such meeting is held in a month, at whichever of those meetings the council by resolution determines, and

b must include in the report a certificate as to whether the investment has been made in accordance with the Act, the regulations and the council's investment policies.

(2) The report must be made up to the last day of the month immediately preceding the meeting.

Certification

I hereby certify the investments summarised in the report have been made in accordance with section 625 of the Local Government Act 1993, clause 212 of the Local Government (General) Regulations 2021 and Council’s Investment Policy.

Emma Galea, Responsible Accounting Officer

Report

Council’s cash and investment portfolio totalled $828.16M as at 31 December 2024. A listing of investments is attached as (Attachment 1) to this report.

Council continues to look for Environmental, Social and Green (ESG) investment opportunities subject to prevailing investment guidelines. ESG investments are highlighted green in (Attachment 1).

As at 31 December 2024 Council’s ESG investments comprised 2.24% or $17M of the total investments portfolio.

Table 1 - Council’s Cash and Investment Portfolio by Type

|

Type |

Carrying Value ($’000) |

|

Investment Portfolio: |

|

|

At Call Account |

$1,666 |

|

Term Deposits |

$270,000 |

|

Floating Rate Notes |

$416,150 |

|

Fixed Rate Bonds |

$64,630 |

|

Floating Bonds |

$5,000 |

|

Transactional accounts and cash in hand |

$70,708 |

|

Total |

$828,154 |

Table 2 - Council’s Portfolio by Fund

Council’s portfolio is held in separate funds by purpose and is summarised as follows:

|

General Fund

($’000) |

Drainage Fund

($’000) |

General Fund Consolidated with Drainage Fund

($’000) |

Domestic Waste Fund

($’000) |

Water and Sewer Fund

($’000) |

|

|

External Restricted Cash |

227,226 |

40,012 |

267,238 |

124,198 |

211,198 |

|

Internal Restricted Cash |

144,437 |

19 |

144,456 |

|

|

|

Total Restricted Cash |

371,663 |

40,031 |

411,694 |

124,198 |

211,198 |

|

Unrestricted Cash |

116,119 |

(35,054) |

81,065 |

|

|

|

Total Cash |

487,782 |

4,977 |

492,759 |

124,198 |

211,198 |

Detailed restrictions are provided in (Attachment 2). It is noted that the amount shown for each respective fund above may be reflected over various restrictions listed in (Attachment 2). The balances above will increase and decrease during each financial year as revenues are received and expenditures occur.

Council continues to set aside funds to enable extinguishment of the remaining emergency loan in November 2025, restricting $1.4M each month for this purpose.

Council is continuing to manage the negative unrestricted funds balance in the Drainage Fund through its consolidation with the General Fund. The negative unrestricted funds balance in the Drainage Fund is $35.05M. From 2026-27 the Drainage Fund will become part of Council’s General Fund as IPART will no longer regulate Stormwater Drainage prices.

In the interim, the unrestricted funds deficit of $35.05M in the Drainage Fund is proposed to be offset through the General Fund’s available unrestricted cash balance.

Portfolio Management

Council’s Investment Portfolio is managed through term deposits, floating rate notes and bonds maturities and placements.

Council’s cash inflows including investment maturities have been used to manage outflows with maturities during the month re-invested taking into consideration operational cashflow requirements.

Table 3 – Portfolio Movement (Investments only)

|

|

2024-25 YTD Actuals ($’000) |

|

Opening Balance |

704,398 |

|

Net Movement |

53,048 |

|

Closing balance |

757,446 |

Net movement includes maturities and new investments.

Refer to Portfolio Valuation Report in (Attachment 3) for more information.

Table 4 - Investment Maturities

Portfolio Performance

Investments are made within Council policy and at the best rates available at the time of placement. Interest rates on investments in the month, ranged from 1.20% to 6.40%.

A comparison of the weighted running yield to key indicators is shown below:

Table 5 – Investment returns

|

|

Weighted running yield |

RBA Cash Rate |

BBSW benchmark |

|

December 2024 |

5.05% |

4.35% |

4.32% |

Table 6 – Performance Statistics

|

|

1 Month |

3 Month |

12 Month |

Since Inception |

|

Portfolio Return 1 |

0.43% |

1.28% |

5.51% |

2.53% |

|

Performance Index 2 |

0.38% |

1.12% |

4.47% |

2.25% |

|

Excess Performance |

0.05% |

0.16% |

1.04% |

0.28% |

1 Portfolio performance is the rate of return of the portfolio over the specified period

2 The Performance index is the Bloomberg AusBond Bank Bill Index

3 Excess performance is the rate of return of the portfolio in excess of the Performance Index

Table 7 – Policy Compliance – Credit Rating

|

Credit Rating Group |

% of portfolio |

Policy Limit |

|

|

BBB |

43.86% |

60.0% |

P |

|

A |

41.08% |

70.0% |

P |

|

AA |

15.06% |

100.0% |

P |

|

AAA |

0.0% |

100.0% |

P |

|

|

100% |

|

|

*Based on face value and Long-Term Rating of Institutions

Table 8 – Policy Compliance – Terms

|

Term |

% of portfolio * |

Policy Limit |

|

|

Cash At Call |

0.22% |

|

|

|

Less than 1 year |

55.43% |

100% |

P |

|

Between 1 and 3 years |

39.39% |

70% |

P |

|

Between 3 and 5 years |

4.96% |

40% |

P |

|

Over 5 years |

0.0% |

5% |

P |

|

|

100% |

|

|

*Based on face value

P compliant

O non-compliant

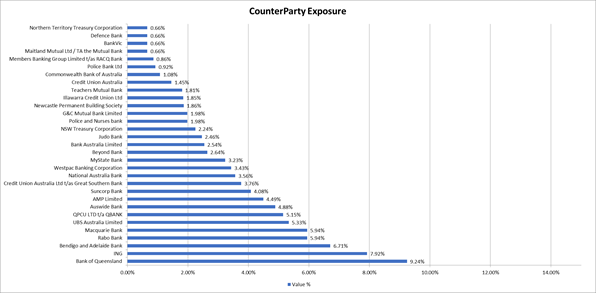

Graph 1 – Counter Party Exposure

Exposure to counterparties is restricted by their rating as per Council’s Policy, so that single entity exposure is limited. Graph 1 shows Council's counter party exposure as at 31 December 2024.

Stakeholder Engagement

Nil.

Financial Considerations

Financial Year (FY) Implications.

The proposal has revenue financial implications for the current FY only.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes the impact for this proposal.

Link to Community Strategic Plan

Theme 4: Responsible

|

Goal G: Good governance and great partnerships |

|

R-G3: Provide leadership that is transparent and accountable, makes decisions in the best interest of the community, ensures Council is financially sustainable and adheres to a strong audit process. |

Risk Management

Cash that is surplus to Council’s immediate requirements is invested within acceptable risk parameters to optimise interest income while ensuring the security of these funds.

Council’s investments are made in accordance with the Local Government Act 1993, Local Government (General) Regulation 2021, Council’s adopted Investments Management and Borrowings Policy, Ministerial Investment Order issued February 2011 and Division of Local Government (as it was then known) Investment Policy Guidelines published in May 2010.

Council monitors and manages the portfolio taking into consideration credit ratings of financial institutions, interest rates offered for the maturity dates required and counterparty exposure.

All of Council’s investments were within Policy guidelines as at 31 December 2024.

Critical Dates or Timeframes

Nil.

Attachments

|

Summary of Investments as at 31 December 2024 |

Provided Under Separate Cover |

D16604346 |

|

|

Summary of Restrictions as at 31 December 2024 |

Provided Under Separate Cover |

D16607257 |

|

|

Portfolio Valuation Report as at 31 December 2024 |

Provided Under Separate Cover |

D16604342 |

|

Item No: 2.4 |

|

|

Title: Monthly Investment Report January 2025 |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Reference: F2025/00016 - D16659463

Author: Michelle Best, Section Manager Financial Accounting and Assets

Manager: Emma Galea, Chief Financial Officer

Executive: Marissa Racomelara, Director Corporate Services

That Council:

1 Notes the Investment Report for January 2025.

2 Notes that the January 2025 unrestricted funds deficit in the Drainage Fund is offset by the unrestricted funds available in the General Fund.

|

Report purpose

To present the monthly Investment Report for January 2025.

Executive Summary

This report provides details of Council’s investment portfolio and performance as at 31 January 2025 |

Background

Clause 212 of the Local Government (General) Regulations 2021 stipulates:

(1) The Responsible Accounting Officer of a Council

a must provide the council with a written report (setting out details of all money

that the council has invested under section 625 of the Act) to be presented

I. if only one ordinary meeting of the council is held in a month, at that meeting, or

II. if more than one such meeting is held in a month, at whichever of those meetings the council by resolution determines, and

b must include in the report a certificate as to whether the investment has been made in accordance with the Act, the regulations and the council's investment policies.

(2) The report must be made up to the last day of the month immediately preceding the

meeting.

Certification

I hereby certify the investments summarised in the report have been made in accordance with section 625 of the Local Government Act 1993, clause 212 of the Local Government (General) Regulations 2021 and Council’s Investment Policy.

Emma Galea, Responsible Accounting Officer

Report

Council’s cash and investment portfolio totaled $844.98M as at 31 January 2025. A listing of investments is attached as (Attachment 1) to this report.

Council continues to look for Environmental, Social and Green (ESG) investment opportunities subject to prevailing investment guidelines. ESG investments are highlighted green in (Attachment 1).

As at 31 January 2025 Council’s ESG investments comprised 2.20% or $17M of the total investments portfolio.

Table 1 - Council’s Cash and Investment Portfolio by Type

|

Type |

Carrying Value ($’000) |

|

Investment Portfolio: |

|

|

At Call Account |

$5,015 |

|

Term Deposits |

$285,000 |

|

Floating Rate Notes |

$416,150 |

|

Fixed Rate Bonds |

$64,630 |

|

Floating Bonds |

$5,000 |

|

Transactional accounts and cash in hand |

$69,181 |

|

Total |

$844,976 |

Table 2 - Council’s Portfolio by Fund

Council’s portfolio is held in separate funds by purpose and is summarised as follows:

|

Fund |

General Fund

($’000) |

Drainage Fund

($’000) |

General Fund Consolidated with Drainage Fund ($’000) |

Domestic Waste Fund

($’000) |

Water and Sewer Fund

($’000) |

|

External Restricted Cash |

227,195 |

40,052 |

267,247 |

120,580 |

230,001 |

|

Internal Restricted Cash |

147,027 |

19 |

147,046 |

|

|

|

Total Restricted Cash |

374,222 |

40,071 |

414,293 |

120,580 |

230,001 |

|

Unrestricted Cash |

115,289 |

(35,186) |

80,103 |

|

|

|

Total Cash |

489,511 |

4,885 |

494,396 |

120,580 |

230,001 |

Detailed restrictions have been provided in (Attachment 2). It is noted that the amount shown for each respective fund above may be reflected over various restrictions listed in (Attachment 2). The balances above will increase and decrease during each financial year as revenues are received and expenditures occur.

Council continues to set aside funds to enable extinguishment of the remaining emergency loan in November 2025, restricting $1.4M each month for this purpose.

Council is continuing to manage the negative unrestricted funds balance in the Drainage Fund through its consolidation with the General Fund. The negative unrestricted funds balance in the Drainage Fund is currently $35.19M. From 2026-27 the Drainage Fund will become part of Council’s General Fund as IPART will no longer regulate Stormwater Drainage prices.

In the interim, the unrestricted funds deficit of $35.19M in the Drainage Fund is proposed to be offset through the General Fund’s available unrestricted cash balance.

Portfolio Management

Council’s Investment Portfolio is managed through term deposits, floating rate notes and bonds maturities and placements.

Council’s cash inflows including investment maturities have been used to manage outflows with maturities during the month re-invested taking into consideration operational cashflow requirements.

Table 3 – Portfolio Movement (Investments only)

|

|

2024-25 YTD Actuals ($’000) |

|

Opening Balance |

704,398 |

|

Net Movement |

71,397 |

|

Closing balance |

775,795 |

Net movement includes maturities and new investments.

Refer to Portfolio Valuation Report in (Attachment 3) for more information.

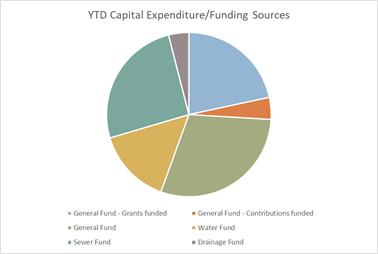

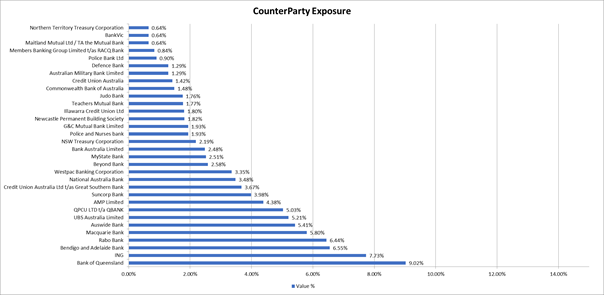

Table 4 - Investment Maturities

Portfolio Performance

The Reserve Bank of Australia (RBA) maintained the cash rate at 4.35% at its meeting in December 2024 and did not meet in January 2025.

Investments are made within Council policy and at the best rates available at the time of placement. Interest rates on investments in the month, ranged from 1.20% to 6.40%.

A comparison of the weighted running yield to key indicators is shown below:

Table 5 – Investment returns

|

|

Weighted running yield |

RBA Cash Rate |

BBSW benchmark |

|

January 2025 |

5.02% |

4.35% |

4.31% |

Table 6 – Performance Statistics

|

|

1 Month |

3 Month |

12 Month |

Since Inception |

|

Portfolio Return 1 |

0.45% |

1.29% |

5.53% |

2.58% |

|

Performance Index 2 |

0.38% |

1.12% |

4.48% |

2.30% |

|

Excess Performance |

0.07% |

0.17% |

1.05% |

0.28% |

1 Portfolio performance is the rate of return of the portfolio over the specified period.

2 The Performance index is the Bloomberg AusBond Bank Bill Index.

3 Excess performance is the rate of return of the portfolio in excess of the Performance Index.

Table 7 – Policy Compliance – Credit Rating

|

Credit Rating Group |

% of portfolio |

Policy Limit |

|

|

BBB |

44.11% |

60.0% |

P |

|

A |

40.76% |

70.0% |

P |

|

AA |

15.13% |

100.0% |

P |

|

AAA |

0.0% |

100.0% |

P |

|

|

100% |

|

|

*Based on face value and Long-Term Rating of Institutions

Table 8 – Policy Compliance – Terms

|

Term |

% of portfolio * |

Policy Limit |

|

|

Cash At Call |

0.65% |

|

|

|

Less than 1 year |

55.41% |

100% |

P |

|

Between 1 and 3 years |

38.88% |

70% |

P |

|

Between 3 and 5 years |

5.06% |

40% |

P |

|

Over 5 years |

0.0% |

5% |

P |

|

|

100% |

|

|

*Based on face value

P compliant

O non-compliant

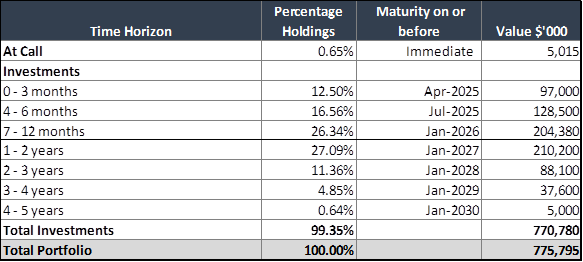

Graph 1 – Counter Party Exposure

Exposure to counterparties will be restricted by their rating as per Council’s Policy, so that single entity exposure is limited. Graph 1 shows Council's counter party exposure as at 31 January 2025.

Stakeholder Engagement

Nil.

Financial Considerations

Financial Year (FY) Implications.

The proposal has revenue financial implications for the current FY only.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes the impact for this proposal.

Link to Community Strategic Plan

Theme 4: Responsible

|

Goal G: Good governance and great partnerships |

|

R-G3: Provide leadership that is transparent and accountable, makes decisions in the best interest of the community, ensures Council is financially sustainable and adheres to a strong audit process. |

Risk Management

Cash that

is surplus to Council’s immediate requirements is invested within

acceptable risk parameters to optimise interest income while ensuring the

security of these funds.

Council’s investments are made in accordance with the Local Government Act 1993, Local Government (General) Regulation 2021, Council’s adopted Investments Management and Borrowings Policy, Ministerial Investment Order issued February 2011 and Division of Local Government (as it was then known) Investment Policy Guidelines published in May 2010.

Council monitors and manages the portfolio taking into consideration credit ratings of financial institutions, interest rates offered for the maturity dates required and counterparty exposure.

All of Council’s investments were within Policy guidelines as at 31 January 2025.

Critical Dates or Timeframes

Nil.

|

Summary of Investments as at 31 January 2025 |

Provided Under Separate Cover |

D16639028 |

|

|

Summary of Restrictions as at 31 January 2025 |

Provided Under Separate Cover |

D16639252 |

|

|

Portfolio Valuation Report as at 31 January 2025 |

Provided Under Separate Cover |

D16639310 |

|

Item No: 2.5 |

|

|

Title: December 2024 (Q2) Quarterly Operational Plan and Budget Review |

|

|

Department: Corporate Services |

|

|

25 February 2025 Ordinary Council Meeting |

|

Reference: F2024/00101 - D16634080

Author: Garry Teesson, Section Manager Financial Planning and Business Support

Sharon McLaren, Section Manager Corporate Planning and Reporting

Vivienne Louie, Senior Financial Project Coordinator Finance

Manager: Emma Galea, Chief Financial Officer

Executive: Marissa Racomelara, Director Corporate Services

That Council:

1 Adopts the December 2024 (Q2) Quarterly Operational Plan and Budget Review, including the proposed amendments and additions to the Operational Plan actions and indicators as outlined in this report and Attachments to this report.

2 Adopts the changes to the 2024-25 capital works program (Attachment 3) and notes the impact of these changes on the indicative program in the outer years.

3 Notes that the proposed 2024-25 Operational Plan and Full Year Budget changes have an impact on Council’s adopted Long Term Financial Plan, but maintain an appropriate operating surplus in the General Fund over the 10 years of the Plan.

|

Report purpose

To report on Central Coast Council’s performance as measured against the organisation’s Operational Plan for 2024-25 financial year. The ‘Q2 Business Report’ (Attachments 1 and 2) covers the progress on the Delivery Program and Operational Plan activities, and financial performance for the period 1 July 2024 to 31 December 2024. It also provides Council’s financial performance and financial position for: · The second quarter (Q2) of the 2024-25 financial year; and · The resulting financial position including proposed Budget variations.

Executive Summary

Operational Plan

Progress Overall performance against the 162 Operational Plan actions and indicators at the end of Q2 shows: • 5 are Completed; • 90 are On Track for delivery by the end of the financial year; • 8 are Delayed; • 1 is Scheduled; and • 2 have been closed.

Financial Performance

Council is required to review its progress in achieving the financial objectives set out in its Operational Plan within two (2) months of the end of each quarter.

The Responsible Accounting Officer has revised Council’s income and expenditure for the 2024-25 financial year and recommends revising estimates in line with Council’s financial performance as at the end of December 2024, and as projected for the remainder of the financial year.

The ‘Q2 Business Report ‘(Attachment 2) recommends Budget adjustments that result in an improved projected operating result for the 2024-25 financial year, on a consolidated basis.

The proposed Q2 adjustments will move the 2024-25 budgeted operating surplus (excluding capital grants and contributions) from $17.3M ($10.7M original budget) to a budgeted operating surplus of $19.1M, on a consolidated basis. Including capital grants and contributions, the budgeted operating surplus will move from $122.7M ($120.3M Original budget) to a $146.9M surplus. These amounts are based on the amortisation of rates and annual charges income across the financial year, consistent with Council’s monthly reporting. Council’s monthly reports are prepared on this basis to assist Council and management in monitoring the organisation’s performance across the year. As the Local Government Code of Accounting Practice and Financial Reporting requires Council to recognise the full year rates and waste management annual charges when levied in July each year, the results on this basis are included in Attachment 2 to this report. The proposed Q2 capital expenditure budget adjustment is a reduction of $12.5M, which will result in a revised 2024-25 full year capital works program of $304.1M. More information and details of progress and financial performance are provided in the ‘Q2 Business Report’, in the Quarterly Budget Review Statement section (Attachment 2). |

Background

As required under the Integrated Planning and Reporting Framework, Council must report on progress with respect to its actions and targets against the objectives of the Delivery Program and Operational Plan, at least every six (6) months.

Clause 203 of the ‘Local Government (General) Regulation 2021’ requires that no later than two (2) months after the end of each quarter (except the June quarter), the Responsible Accounting Officer of Council must prepare and submit to Council a Quarterly Budget Review Statement (QBRS) that shows a revised estimate of the income and expenditure for that year.

This QBRS is presented in the necessary format (Attachments 1 and 2) and meets relevant legislative requirements.

Report

Operational Plan Actions and Indicators

The table below is a summary of the overall progress on the actions and indicators for Q2. The information contained in (Attachment 1) includes specific details of progress.

|

Theme: |

Belonging |

Smart |

Green |

Responsible |

Liveable |

Total |

|

Completed |

0 |

1 |

0 |

2 |

2 |

5 |

|

On Track |

20 |

8 |

13 |

31 |

18 |

90 |

|

Delayed |

0 |

0 |

0 |

7 |

1 |

8 |

|

Scheduled |

0 |

0 |

0 |

0 |

1 |

1 |

|

On Hold |

0 |

0 |

0 |

0 |

0 |

0 |

|

Closed |

0 |

0 |

0 |

1 |

1 |

2 |

|

Total |

20 |

9 |

13 |

41 |

23 |

106 |

Financial Performance

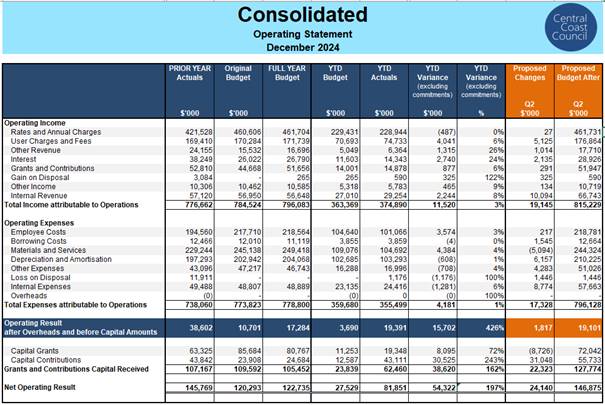

As at the end of Q2 Council has a consolidated net operating surplus of $19.4M, before capital income, which is favourable to budget by $15.7M and a net operating surplus including capital income of $81.9M, which is favourable to budget by $54.3M. These results reflect the amortisation of annual rates and charges. Variance detail analysis is included in the Monthly Finance Report December 2024 included as a separate report in this business paper.

Table 1 - Consolidated Operating Statement December 2024

NB: Figures are subject to rounding.

It is noted that as part of the Q2 Budget review process, the phasing of planned income and expenditure has been reviewed to ensure changes to projections required to reflect Budget trend are captured in a timely manner.

As at Q2, Council’s overall performance was better than Budget as financial discipline continues to be applied to all expenditure and trends are monitored. Actual financial performance as at the end of 2023-24 financial year has been considered when revising projections as part of the Q2 quarterly budget review process.

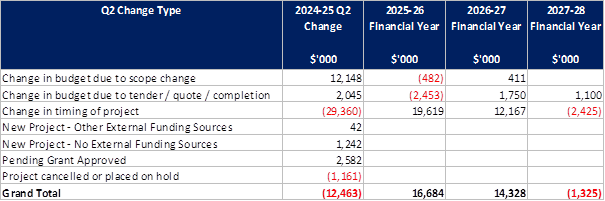

Capital Works

Actual Q2 YTD capital expenditure is $124.9M against the Q2 YTD budget of $132.1M and a 2024-25 FY budget of $316.5M.

Financial Performance Benchmarks

Below is a summary of Council’s performance, against the main financial performance benchmarks set by the Office of Local Government.

Table 2 – Financial Performance Benchmarks - December 2024

|

Financial Performance Ratio |

Industry Benchmark |

Full year Forecast |

Ratio – YTD Actuals |

|

|

Operating Performance Ratio |

> 0% |

1.47% |

5.6% |

P |

|

Own Source operating Revenue Ratio |

> 60% |

81.57% |

80.9% |

P |

|

Unrestricted Current Ratio |

>1.5x |

2.57x |

4.6x |

P |

|

Cash Expense Cover Ratio |

> 3 months |

3.44 months |