Economic Development Committee

06 May 2025

|

Economic Development Committee

06 May 2025

|

Oath or Affirmation of Office

Councillors are reminded of their Oath or Affirmation of Office to undertake their duties in the best interests of the people of the Central Coast and Council and to faithfully and impartially carry out the functions, powers, authorities, and discretions vested in them under the Local Government Act 1993, or any other Act to the best of their ability and judgement. Councillors are also reminded of their obligations under the Code of Conduct to disclose and appropriately manage conflicts of interest.

Disclosures of Interest

Councillors are reminded of their obligation under Council’s Code of Conduct to declare any conflict of interest in a matter considered by Council.

Pecuniary interest: A Councillor who has a pecuniary interest in any matter with which the Council is concerned, and who is present at a meeting of the Council at which the matter is being considered, must disclose the nature of the interest to the meeting. The Councillor must not be present at, or in sight of, the meeting:

a) At any time during which the matter is being considered or discussed, or

b) At any time during which the Council is voting on any question in relation to the matter.

Non-Pecuniary conflict of interest: A Councillor who has a non-pecuniary conflict of interest in a matter, must disclose the relevant private interest in relation to the matter fully and on each occasion on which the non-pecuniary conflict of interest arises in relation to the matter.

Significant Non-Pecuniary conflict of interest: A Councillor who has a significant non-pecuniary conflict of interest in relation to a matter under consideration at a Council meeting, must manage the conflict of interest as if they had a pecuniary interest in the matter.

Non-Significant Non-Pecuniary interest: A Councillor who determines that they have a non-pecuniary conflict of interest in a matter that is not significant and does not require further action, when disclosing the interest it must also be explained why the conflict of interest is not significant and does not require further action in the circumstances.

Recording

In accordance with the NSW Privacy and Personal Information Protection Act 1998, you are advised that all discussion held during the Open Council meeting is recorded for the purpose of livestreaming the public meeting and verifying the minutes. This will include any public discussion involving a councillor, staff member or a member of the public.

Meeting Notice

The Economic Development Committee

of Central Coast Council

will be held in Function Room 2,

2 Hely Street,

Wyong,

on Tuesday 6 May 2025 at 5:00pm,

for the transaction of the business listed below:

1 Reports

1.1 Introduction: Welcome, Acknowledgement of Country, and Apologies................................. 5

1.2 Disclosures of Interest.............................................................................................................................. 5

1.3 Confirmation of Minutes of Previous Meeting................................................................................. 7

1.4 Business NSW........................................................................................................................................... 13

1.5 Upcoming Projects on the Central Coast including 2 Wella Way, Somersby by Space Urban....................................................................................................................................................................... 13

1.6 Destination Central Coast, Visitor Economy Update.................................................................... 13

1.7 Economic Development Strategy and Destination Management Plan Project Update... 13

1.8 Draft Central Coast Employment Land Strategy - Public Exhibition....................................... 19

1.9 Central Coast Air Show........................................................................................................................ 201

1.10 Business Retention and Expansion Survey Report..................................................................... 209

ITEM 1.1

WELCOME

ACKNOWLEDGEMENT OF COUNTRY

We acknowledge the Traditional Custodians of the land on which we live, work and play.

We pay our respects to Darkinjung Country, and Elders past and present.

We recognise the continued connection to these lands and waterways and extend this acknowledgement to the homelands and stories of those who also call this place home.

We recognise our future leaders and the shared responsibility to care for and protect our place and people.

RECEIPT OF APOLOGIES

|

Chapter 14 of the Local Government Act 1993 (“LG Act”) regulates the way in which the councillors and relevant staff of Council conduct themselves to ensure that there is no conflict between their private interests and their public functions.

Section 451 of the LG Act states:

“(1) A councillor or a member of a council committee who has a pecuniary interest in any matter with which the council is concerned and who is present at a meeting of the council or committee at which the matter is being considered must disclose the nature of the interest to the meeting as soon as practicable.

(2) The councillor or member must not be present at, or in sight of, the meeting of the council or committee:

(a) at any time during which the matter is being considered or discussed by the council or committee, or (b) at any time during which the council or committee is voting on any question in relation to the matter.

(3) For the removal of doubt, a councillor or a member of a council committee is not prevented by this section from being present at and taking part in a meeting at which a matter is being considered, or from voting on the matter, merely because the councillor or member has an interest in the matter of a kind referred to in section 448.

(4) Subsections (1) and (2) do not apply to a councillor who has a pecuniary interest in a matter that is being considered at a meeting, if:

(a) the matter is a proposal relating to:

(i) the making of a principal environmental planning instrument applying to the whole or a significant part of the council’s area, or

(ii) the amendment, alteration or repeal of an environmental planning instrument where the amendment, alteration or repeal applies to the whole or a significant part of the council’s area, and

(a1) the pecuniary interest arises only because of an interest of the councillor in the councillor’s principal place of residence or an interest of another person (whose interests are relevant under section 443) in that person’s principal place of residence, and

(b) the councillor made a special disclosure under this section in relation to the interest before the commencement of the meeting.

(5) The special disclosure of the pecuniary interest must, as soon as practicable after the disclosure is made, be laid on the table at a meeting of the council and must:

(a) be in the form prescribed by the regulations, and (b) contain the information required by the regulations.”

Further, the Code of Conduct adopted by Council applies to all councillors and staff. The Code relevantly provides that if a councillor or staff have a non-pecuniary conflict of interest, the nature of the conflict must be disclosed as well as providing for a number of ways in which a non-pecuniary conflicts of interests might be managed.

|

That Committee members and staff now disclose any conflicts of interest in matters under consideration at this meeting.

|

Item No: 1.3 |

|

|

Title: Confirmation of Minutes of Previous Meeting |

|

|

Department: Corporate Services |

|

|

6 May 2025 Economic Development Committee |

|

Reference: F2025/00095 - D16794643

Recommendation

That the Committee confirm the minutes of the previous Economic Development Committee held on Tuesday 1 April 2025.

|

Summary

Confirmation of minutes of the previous Economic Development Committee held on Tuesday 1 April 2025. |

|

1⇩ |

MINUTES - Economic Development Committee - 1 April 2025 |

|

D16758362 |

|

1.3 |

Confirmation of Minutes of Previous Meeting |

|

Attachment 1 |

MINUTES - Economic Development Committee - 1 April 2025 |

Scott Goold – Regional Director Central Coast

1.5 Upcoming Projects on the Central Coast including 2 Wella Way, Somersby by Space Urban

Allison Basford, Chief Executive Officer, Space Urban

Mark Daniels, Planning & Development Manager, Space Urban

1.6 Destination Central Coast, Visitor Economy Update

Bianca Gilmore, Section Manager Destination Marketing and Visitor Services

|

Item No: 1.7 |

|

|

Title: Economic Development Strategy and Destination Management Plan Project Update |

|

|

Department: Community and Recreation Services |

|

|

6 May 2025 Economic Development Committee |

|

Reference: F2025/00095 - D16777362

Author: Bianca Gilmore, Section Manager Destination Marketing and Visitor Services

Andrew Powrie, Business Economic Development Manager

Manager: Sue Ledingham, Unit Manager Customer Marketing and Economic Development

Executive: Melanie Smith, Director Community and Recreation Services

That the Committee Note the Economic Development Strategy and Destination Management Plan Project Update.

|

Report purpose

This information Report is to provide an update on the status and proposed timings of the development of both the Economic Development Strategy 2026-2029 (EDS) and Destination Management Plan 2026-2029 (DMP).

Executive Summary

The new Central Coast Economic Development Strategy and Destination Management Plan will be developed together sharing (where possible) critical path milestones inclusive of; stakeholder workshops and reporting to the Economic Development Committee and Council.

This report provides the Economic Development Committee with the high-level project timeline for both projects. |

Background

This information report provides an update on the status and proposed timings of the development of both the Economic Development Strategy 2026-2029 (EDS) and Destination Management Plan 2026-2029 (DMP).

The purpose of this report responds to an action from the Economic Development Committee, to outline the approach for concurrently developing the EDS and the DMP, demonstrating alignment between the two strategies and reflecting the Council’s broader economic and community goals.

Economic Development Strategy

The current EDS 2020-2040 was completed for the Central Coast in 2020, the strategy focuses on a broader policy context, reflecting the wider perspective and aspirations of our region. This high-level strategy had a 20 year-time frame but primarily focused on immediate actions to address recovery impacts of the COVID-19 Pandemic. Council will develop a new strategy that responds to driving change in our economy, strengthening for further growth and success for the Region.

Destination Management Plan

The current DMP 2022-2025 has provided a strategic foundation for tourism development, destination marketing and visitor economy growth across the Central Coast. With this plan reaching its conclusion, there is an opportunity for a renewed strategy to respond to evolving visitor trends, community aspirations and regional economic priorities.

Report

A strong economy is vital to the overall health and long-term sustainability of the Central Coast Region. For residents and businesses to enjoy a sustained level of growth and prosperity, the Central Coast must become a preferred location for living, working and business growth and investment.

The purpose of economic development is to build the economic capacity and capability of a local region to improve its economic future and the quality of life for residents. Our greatest long-term economic challenge is to grow and attract businesses while increasing job opportunities for our resident workforce, which will grow the local economy as more dollars are retained locally.

The new Central Coast Economic Development Strategy (EDS) represents an opportunity for Council to establish a new direction for its economic development program, and the new Destination Management Plan (DMP) will be a cornerstone piece to achieving economic development outcomes for the Central Coast, as developing the Visitor Economy is a crucial placemaking element for the brand identity of the Central Coast, marketing and positioning, “selling,” our region to both visitors and investors alike.

Where possible staff will combine reporting and workshops with internal stakeholders and industry. When that isn’t possible, we will ensure all data, information and insights secured are incorporated in the development of both strategic documents. This integrated approach ensures consistency, reduces duplication, and supports a unified vision for economic and visitor economy growth across the region.

Project timeline includes:

|

Subject |

Date |

|

Discovery and Research |

April – May 2025 |

|

Stakeholder Workshop – with Internal and External stakeholders |

May – June 2025 |

|

Workshop with Economic Development Committee |

June 2025 |

|

Develop the draft EDS and the DMP |

July – August 2025 |

|

Draft EDS and DMP to be presented to Executive Leadership Team |

August 2025 |

|

Draft EDS and DMP to be presented to Economic Development Committee |

October 2025 |

|

Councillor Briefing |

October 2025 |

|

Public Exhibition |

November 2025 |

|

Final EDS and DMP developed inclusive of Exhibition results/insights |

December 2025 – January 2026 |

|

Final EDS and DMP presented to Economic Development Committee |

February 2026 |

|

Council adoption of both strategic documents |

March 2026 |

Stakeholder Engagement

The Economic Development and Destination Marketing and Visitor Services Sections of Council have collaborated to produce a replicable project timeline incorporating the EDS and DMP.

As the project progresses there will be significant internal and external stakeholder engagement. A joint mapping exercise has occurred across both Sections and the Project Critical Path will have a comprehensive engagement plan developed against those Stakeholders identified.

The DMP and EDS is informed by independent research and analysis, as well as stakeholder and community engagement, which will be a critical component, with consultation to be undertaken across local industry, community groups, businesses, residents, Council and Government stakeholders.

Financial Considerations

Financial Year (FY) Implications.

The proposal has cost financial implications for the current FY and outer years in the LTFP.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes the impact for this proposal.

The Economic Development Strategy does not have any financial implications as the review and production will be undertaken in house. There is an allocated budget to support in-depth interviews.

The development of the DMP will be delivered through existing resourcing within the Destination Marketing and Visitor Services team and supported by an allocated budget for external consultancy in the budget and workplan.

Link to Community Strategic Plan

Theme 2: Smart

|

Goal C: A growing and competitive region |

|

S-C1: Target economic development in growth areas and major centres and provide incentives to attract businesses to the Central Coast. |

|

S-C3: Facilitate economic development to increase local employment opportunities and provide a range of jobs for all residents. |

|

S-C4: Promote and grow tourism that celebrates the natural and cultural assets of the Central Coast in a way that is accessible, sustainable and eco-friendly. |

|

S-D2: Support local business growth by providing incentives, streamlining processes and encouraging social enterprises. |

Theme 3: Green

|

G-E1: Educate the community on the value and importance of natural areas and biodiversity, and encourage community involvement in caring for our natural environment. |

Theme 4: Responsible

|

Goal G: Good governance and great partnerships |

|

R-G1: Build strong relationships and ensure our partners and community share the responsibilities and benefits of putting plans into practice. |

Risk Management

Risks relate to the

ability to resource the Project to meet timings identified. This will be

mitigated by a prescriptive and detailed critical path with real time exception

reporting occurring.

Risks to Council’s reputation from poorly coordinated actions or under-resourced teams to progress the development of the EDS and the DMP within the allocated timeframe. Risk is mitigated through a dedicated internal team, resourceful stakeholder consultation, internal collaboration, and the strategic provision of actions in existing and newly founded Council strategies and operational plans.

Critical Dates or Timeframes

Critical dates and time limits are identified in the project timeline mentioned above. The development of the EDS and the DMP will follow a structured timeline with key milestones including stakeholder engagement and public exhibition scheduled for later in 2025. The final strategies are expected to be completed and presented for Council adoption by March 2026.

Nil.

|

Item No: 1.8 |

|

|

Title: Draft Central Coast Employment Land Strategy - Public Exhibition |

|

|

Department: Environment and Planning |

|

|

6 May 2025 Economic Development Committee |

|

Reference: F2022/01641 - D16617341

Author: Syeda Samina, Strategic Planner Local Planning and Policy

Manager: Scott Duncan, Section Manager Local Planning and Policy

Executive: Shannon Turkington, Unit Manager Strategic Planning

That the Committee:

1 Endorses the draft Central Coast Employment Land Strategy (Attachment 1) and Background Report (Attachment 2) to be placed on public exhibition for a minimum of 42 days.

2 Receives a report on the outcome of the community consultation.

|

Report purpose

To seek the Committee’s endorsement of the draft Central Coast Employment Land Strategy and Background Report to be publicly exhibited for a period of not less than 42 days.

Executive Summary

The draft Central Coast Employment Land Strategy has been prepared to guide the future development and management of employment lands within the Central Coast Local Government Area (LGA). With increasing pressure from urbanisation, economic growth and changing workforce demands, there is a need for a coordinated, long-term plan to maximise the potential of available employment land. This strategy provides a clear vision to inform amendments to the Local Environmental Plan (LEP) and guides decision-making for future development proposals. It aims to protect strategic employment lands, enhance infrastructure provision and prioritise key investments in the region. The draft report has reviewed all existing employment lands within the Central Coast LGA through an analysis of current market trends and drivers, identifying supply and capacity, and projecting future floorspace/land requirements to accommodate additional growth required to meet employment/population targets. |

Background

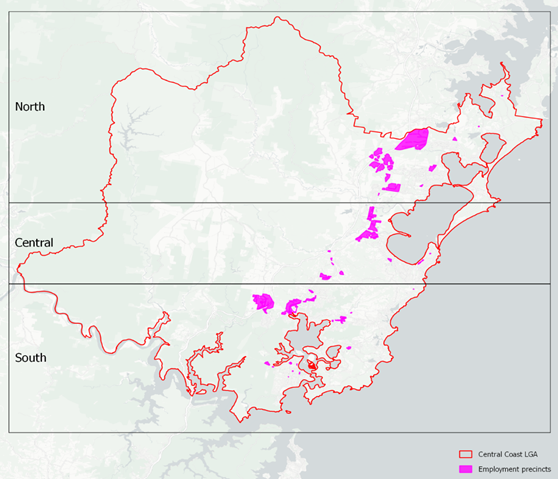

Employment lands play an important role in generating employment and contributing to the local economy. They offer uses that boost productivity across the region and provide services that support residents. Positioning Central Coast as an attractive place to invest, means building on its competitive advantages. Figure 1, below, shows the location of existing Employment precincts.

As defined by the Department of Planning, Housing and Infrastructure’s (NSW DPHI) Employment Lands Development Monitor (ELDM), employment lands are defined as:

“Land zoned for industrial or similar purposes in planning instruments. They are generally lower density employment areas containing concentrations of businesses involved in: manufacturing; transport and warehousing; service and repair trades and industries; integrated enterprises with a mix of administration, production, warehousing, research and development; and urban services and utilities.”

Employment land is vital to the functioning of urban areas, providing space for:

· Essential services such as waste and water management, repair trades and construction services

· Warehousing, logistics and distribution centres

· Areas for businesses that design, manufacture and produce goods and services

· Employment lands primarily encompass land zoned as E3 Productivity Support; E4 General Industrial; W4 Working Waterfront; and SP4 Enterprise.

The draft Employment Land Strategy seeks to provide a clear vision and strategic direction to inform Local Environmental Plan amendments and establish appropriate development controls for employment land uses. It also seeks to provide clear principles and actions to guide future decision making by Council in relation to planning proposals for employment lands, particularly to:

· Protect strategically important lands, and

· Inform consideration of planning proposals (rezoning) of new lands.

A two-phase approach was undertaken for the project resulting in a background and land use audit report and a separate strategy document which has been produced by Council’s consultant (Hill PDA).

· Phase 1: The Background Report provides a robust evidence base to inform the strategy. It identifies and catalogues all employment lands in the LGA, explores planning, market and location context, considers constraints, analyses demographics and supply and demand, and describes consultation outcomes.

· Phase 2: The Strategy applies at an LGA level with precinct specific actions and recommendations. Overall, the Strategy establishes a clear direction for future industrial and urban service development across the Central Coast over the next 20 years.

Figure1 identifies zoned employment land across the Central Coast. The main zones covered by the draft Employment Land Strategy are E3 – Productivity Support, E4 General Industrial, SP4 – Enterprise and W4- Working Waterfront. The Strategy does not address commercial lands, Strategic Planning is preparing a Commercial Lands Strategy which will be reported to ELT and Council in late 2025.

Figure 1: Central Coast employment precincts (Source HILL PDA 2023)

Report

Supply Availability and Demand

As of October 2023, there was around 2,190 ha of employment zoned land spread across 29 employment precincts on the Central Coast LGA. Figure 2 provides a breakdown of the Central Coast’s employment land based on whether the land is vacant or occupied, servicing and land constraints.

Figure 2: Employment land area overview (Source: HillPDA, October 2023)

A key attractor of the Central Coast is the significant amount of zoned employment land, of which, around 933 hectares is undeveloped land. A breakdown of the vacant land servicing and constraints analysis by employment precinct is provided in Table 1.

A constraints analysis has been undertaken based on two development constraint

categories for the employment precincts of Central Coast:

· Hard Constraints - Land below Council’s Flood prone Planning Level (FPL) and heritage constraints.

· Partial Constraints - Flooding (land between the FPL and PMF), Strategic agricultural land, mapped wildlife corridors, key habitat for threated species, mapped native vegetation, bushfire prone land and drinking water catchment areas.

Whilst the Central Coast has a significant amount of zoned employment lands, the majority of zoned vacant employment land is mapped under the ‘Partial Constraint’ category. Some of these constraints will limit these sites from being fully developed.

Bushells Ridge, Somersby and Wyong Employment Zone (WEZ) precincts are three of the largest employment precincts on the Central Coast with the most vacant zoned employment land. All three precincts contain ecological constraints that considerably reduce the feasibility and capacity of development. These sites will require biodiversity offset and bio-certification solutions to provide streamlined biodiversity approvals before they can provide market ready land to the employment supply pipeline. Parts of the WEZ and Bushells Ridge also lack infrastructure (water and sewer) and require large scale intersection upgrades to meet expected growth.

Table 1: Employment precincts with vacant land stock available by constraints and serviceability (Source: HillPDA, October 2023)

|

Precinct |

Serviceable and unconstrained |

Un-serviced but unconstrained |

Serviceable and partial constraints |

Un-serviced and partial constraints |

Total vacant land |

|

Bushells Ridge |

3.2 |

19.5 |

14.7 |

423.6 |

461 |

|

Somersby |

40.2 |

7.5 |

69.5 |

18.9 |

136 |

|

Wyong |

13.5 |

6.8 |

24 |

31.3 |

75.6 |

|

West Gosford |

5.2 |

2.7 |

3 |

0.3 |

11.1 |

|

North Wyong |

6.8 |

0.1 |

1.8 |

0 |

8.7 |

|

Lisarow |

1.4 |

0 |

3.6 |

0 |

5 |

|

Tuggerah |

3.6 |

0.4 |

0.5 |

0.4 |

4.8 |

|

Charmhaven |

2.3 |

0 |

1.3 |

0 |

3.6 |

|

Doyalson |

2.5 |

0 |

0 |

0 |

2.5 |

|

West Gosford South |

1.8 |

0 |

0.2 |

0 |

2 |

|

Woy Woy, South |

0 |

0.4 |

0 |

1.3 |

1.7 |

|

Nth Gosford & Wyoming |

0.6 |

0.1 |

0.1 |

0 |

0.8 |

|

Erina |

0.4 |

0 |

0 |

0 |

0.4 |

|

Wyong Hospital |

0.2 |

0 |

0 |

0 |

0.2 |

|

Blackwall |

0 |

0 |

0 |

0.1 |

0.1 |

|

Long Jetty |

0.1 |

0 |

0 |

0 |

0.1 |

|

The Entrance Rd |

0 |

0 |

0.1 |

0 |

0.1 |

|

Woy Woy, Rawson Rd |

0.1 |

0 |

0 |

0 |

0.1 |

|

Woy Woy, Alma Ave |

0.05 |

0 |

0 |

0 |

0.05 |

|

Total |

81.6 |

37.4 |

118.8 |

475.9 |

713.7 |

It was estimated by Hill PDA that to accommodate the projected growth in employment on the Central Coast, there was demand for an additional 208 to 286 ha of employment land across the Central Coast from now until 2041. If only the land that was serviced and unconstrained (short term supply) is considered, the Central Coast would have sufficient serviced and unconstrained land to meet this demand. The draft ELS recommends that a major policy focus for government should be to unlock at least 60 ha of employment land by ensuring that biodiversity and infrastructure servicing issues are resolved to meet demand by 2041.

Opportunities and Challenges

The Central Coast has strong transport connections, a growing population and enviable lifestyle assets. There is significant opportunity to address challenges and leverage strengths to grow the Central Coast as an employment destination. The following challenges have been identified through the analysis process.

· Unlocking a pipeline of vacant, unconstrained, serviced land - majority of the vacant land contains constraints, some of which are considered ‘partial’, however would likely impact yield, delivery timeframes and feasibility.

· Improving job containment - Actively facilitating job opportunities and promoting the appeal of the Central Coast as an employment destination would assist in expanding internal employment opportunities and attracting further business investment.

· Infrastructure delivery - Council does not always have the funds to deliver infrastructure including stormwater, water, sewerage, electricity, telecommunications, roads and other services. Council often needs to lobby for additional funds from the State or Federal Governments to deliver infrastructure required for employment lands.

· Protecting land for high value industrial use - Congestion and poor connectivity add to travel costs and time, reducing the appeal of locations for employees and operating costs for Industrial businesses (manufacturing & distribution).

· Poor internal road connectivity - Employment sites on Central Coast Highway have poor accessibility for businesses that are reliant on distribution and connectivity.

· Protecting urban service pockets - Protection of industrial and urban service land in close proximity to residential catchments.

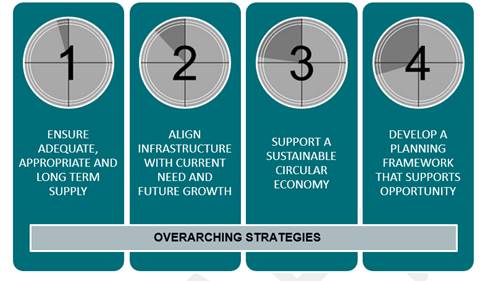

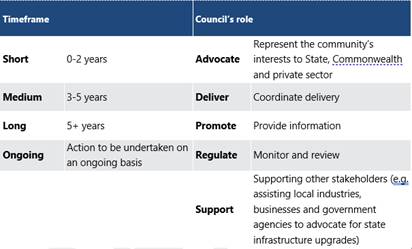

The draft ELS outlines four (4) overarching Strategies (Figure 3) and accompanying actions to guide future employment land requirements and land use to 2041.

Figure 3: Four overarching strategies (Source: HillPDA, 2024)

The accompanying Strategies and Actions are proposed to by the draft ELS (see Table 2)

Table 2: Summary of Actions

|

STRATEGY ONE – ENSURE ADEQUATE, APPROPRIATE AND LONG-TERM SUPPLY |

||||

|

Action |

What will success look like |

Timing |

Council’s role |

|

|

Action 1.1- Coordinate infrastructure, land use and service planning to meet future employment needs. |

Monitor the release of employment land by working with the State Government to establish the Urban Development Program (UDP) to monitor and analyse the supply and take up of employment lands on the Central Coast. |

Completion of the Development Supply Pipeline and ongoing reporting to inform the UDP for the Central Coast. At least 12 to 16ha of market ready land is brought online annually.

|

Ongoing |

Regulate |

|

Action 1.2- Investigate additional options for future land supply to meet demand. |

Investigate and support the development of Place Plans, Masterplans and Structure Planning for future employment precincts identified in the Central Coast Regional Plan (CCRP) and future investigation areas (Chapter 10 of Background Report).

|

A pipeline of precincts to undergo further investigation and planning to deliver the 60 additional hectares needed. |

Long |

Deliver |

|

Action 1.3- Support landowner and State Government led Place Plans and investigations to plan for future employment land growth. |

Work with landowners and stakeholders to establish a pipeline of employment land by:

· Supporting State Government planning initiatives to promote Gosford as the region’s capital with the creation of an education and employment precinct integrating the redevelopment of Gosford Hospital, Central Coast Clinical School and Research Institute, and University of Newcastle campus on Mann Street · Working with Hunter Central Coast Development Corporation and TfNSW to resolve heritage and traffic issues at the Mount Penang site at Kariong. Consider if part of the site should be rezoned for E3 Productivity Support and opportunities for the precinct to be utilised for the purpose of festivals, entertainment, and complementary commercial uses. · Support proponents in the development of precinct wide planning proposals that respond to the Employment Land Study and CCRP 2041.

|

Precinct wide rezoning proposals submitted by proponents and subsequent amendments to the Central Coast LEP and DCP 2022 enabling employment lands to be delivered in suitable locations. |

Ongoing |

Support |

|

Action 1.4- Stimulate employment and economic activity with consideration of important ecological constraints surrounding the airport lands and WEZ (Wyong Employment Zone) |

Finalise the master plan for Central Coast Airport and Warnervale Business Precinct. |

Master plans completed. |

Short |

Deliver |

|

Action 1.5- Continue to pursue opportunities to utilise Council-owned land to deliver employment lands. |

Investigate opportunities for ancillary employment land uses around the Buttonderry Waste Management Facility for businesses that rely on being proximate to the waste facility.

|

Consideration of ancillary businesses as part of future management plans for the site. |

Long |

Deliver |

|

STRATEGY TWO – ALIGN INFRASTRUCTURE WITH CURRENT NEED AND FUTURE GROWTH |

||||

|

Objective |

Action |

What will success look like |

Timing |

Council’s role |

|

Action 2.1- Coordinate infrastructure, land use and service planning to meet future employment needs |

Actively participate and direct the Urban Development Program (UDP) to address servicing requirements and staging for employment precincts. |

Implementation of Council’s infrastructure and servicing plan |

Ongoing |

Support |

|

Action 2.2- Advocate for a coordinated infrastructure planning and delivery program |

Advocate to the NSW State Government and the Federal Government for funding of priority infrastructure projects as identified within Council’s 10-year priority infrastructure plan including: · Completion of the Pacific Highway upgrade and Link Road from Wyong to Warnervale. · Funding of major intersection upgrades on State Road network to provide catalyst for the development of industrial land at Somersby Business Park and the Wyong Employment Zone. · Fast Rail Program roll out and seek to leverage opportunities for employment. · Funding to support the implementation of a rapid bus along the growth corridors to enhance connectivity between employment precincts and support the delivery of the 15-minute city initiative in the CCRP 2041. Locations that have the capacity to deliver a greater number of jobs and economic contribution should be prioritised. |

Funding secured for major infrastructure projects that unlock employment land and deliver jobs. |

Ongoing |

Advocate |

|

Action 2.3- Ensure development contributes to the cost of public infrastructure through contribution plans and Planning Agreements

|

Amend contribution plans, and/or seek planning agreements, to identify and fund infrastructure improvement works and the increased demand for public amenities and public services, created by Planning Proposals for employment lands.

|

Identify infrastructure required to deliver employment land development sites on the Central Coast.

Updated Section 7.11 and Section 7.12 Plan that considers the growth expected to occur in the Central Coast Area |

Ongoing |

Deliver |

|

STRATEGY THREE – SUPPORT A SUSTAINABLE CIRCULAR ECONOMY |

||||

|

Objective |

Action |

What will success look like |

Timing |

Council’s role |

|

Action 3.1-Encourage more employment and economic activity with development of integrated resource recovery precincts. |

Foster circular economy initiatives by encouraging the implementation of circular economy principles that co-locate recycling and reprocessing facilities, including near Councils waste management facilities.

|

Implementation of Central Coast Resource Management Strategy 2020-2030 actions. |

Long |

Promote |

|

Action 3.2-Effectively repurpose the Colongra Power Station site to contribute to employment generation and a circular economy.

|

Work with stakeholders to investigate the suitability of the Colongra Power Station site for industry or investigate potential for alternate suitable employment uses. |

A structure plan for the power station site. |

Medium |

Support |

|

STRATEGY 4 – DEVELOP A PLANNING FRAMEWORK THAT SUPPORTS OPPORTUNITY |

||||

|

Objective |

Action |

What will success look like |

Timing |

Council’s role |

|

Action 4.1- Update employment land use provisions within the Central Coast Local Environmental Plan 2022 (CCLEP) and Central Coast Development Control Plan 2022 (CCDCP). |

Review and update CCLEP 2022 and CCDCP 2022 to address the following: · Investigate the possibility of including a minimum lot size for employment lands in close proximity to the M1 Pacific Motorway and B-double routes to ensure sufficient availability of large industrial lots. · Investigate the removal of shop top housing permissibility from the E3 Productivity Support zone to reduce potential land use conflicts. Instead focus residential in centres and along mixed-use corridors. · Consider applying the E3 Productivity Support zoning to promote the establishment of low impact businesses where residential and industrial interface areas occur to better manage potential land use conflicts in appropriate locations. · Develop site specific DCP Chapter for the Wyong Employment Zone. Review and update Industrial and Site-Specific Employment Precinct DCP chapters to ensure they are up to date and represent best practice. |

Amendments completed to the Central Coast Local Environmental Plan 2022 and Development Control Plan 2022 to implement the required changes. |

Medium |

Deliver |

|

Action 4.2- Seek to streamline approval processes for employment lands and reduce development uncertainty. |

Balance environmental and employment priorities by: · Supporting the Department Planning, Housing and Infrastructure in completing the Central Coast Strategic Conservation Plan to bio-certify future employment lands and streamline threatened species assessment processes.

|

Minister for the Environment grants biodiversity certification. |

Medium |

Support |

Further to the above Strategies and Actions the draft ELS contains an implementation plan (see below for extract):

![]()

Stakeholder Engagement

Stakeholder consultation was undertaken by Hill PDA to develop the draft Employment Land Study and Strategy by undertaking targeted phone calls. This consultation occurred with local business owners, major landowners, real estate agents, state government agencies (DPHI) and several industry groups. The purpose of this feedback was to obtain feedback on perception and ideas that contributes to the community’s understanding of employment land issue and needs of the Central Coast.

Internal staff consultation has occurred with relevant staff from the Customer Marketing and Economic Development Unit, Water and Sewer, Waste & Resource Recovery, Local Infrastructure Planning Section and Development Assessment Unit.

The draft Central Coast Employment Land Study and Strategy is proposed to be placed on public exhibition for 42 days. Drop-in sessions are proposed to occur during the public exhibition period to provide an opportunity for interested stakeholders and the community to meet with staff and ask specific questions about the strategy. The outcomes of the public exhibition process will be reported to Economic Development Committee following the conclusion of the exhibition period.

Financial Considerations

Financial Year (FY) Implications.

The proposal has revenue financial implications for the current FY and outer years in the LTFP.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes funding for this proposal, but the LTFP does not include funding for the ongoing impact and will need to be updated in the next review.

Exhibition of the draft ELS will not have direct material financial implications for Council. If adopted, the actions contained within the draft ELS will need to be considered when setting priorities for Council’s Strategic Planning work program under Council’s Operational Plan.

Link to Community Strategic Plan

Theme 2: Smart

|

Goal C: A growing and competitive region |

|

S-C1: Target economic development in growth areas and major centres and provide incentives to attract businesses to the Central Coast. |

|

Goal C: A growing and competitive region |

|

S-C2: Revitalise Gosford City Centre, Gosford Waterfront and town centres as key destinations and attractors for business, residents, visitors and tourists. |

Theme 4: Responsible

|

Goal H: Delivering essential infrastructure |

|

R-H4: Plan for adequate and sustainable infrastructure to meet future demand for transport, energy, telecommunications and a secure supply of drinking water. |

|

Goal I: Balanced and sustainable development |

|

R-I3: Ensure land use planning and development is sustainable and environmentally sound and considers the importance of local habitat, green corridors, energy efficiency and stormwater management. |

Risk Management

Council needs to

adopt an employment lands strategy to ensure there is an adequate supply of

employment lands to drive economic development within the Central Coast over

the next 20 years horizon.

The exhibition of the draft ELS is an essential step to ensure adequate community engagement is undertaken prior to adoption of the ELS.

The risk to Council if the draft ELS is not exhibited prior to adoption is that the views of residents, interest groups and agencies are not adequately considered in the adopted ELS.

Critical Dates or Timeframes

Nil.

|

1⇩ |

Draft Central Coast Employment Land Strategy |

|

D16757999 |

|

2⇩ |

Draft Central Coast Employment Land Background Report |

|

D16758001 |

|

1.8 |

Draft Central Coast Employment Land Strategy - Public Exhibition |

|

Attachment 1 |

Draft Central Coast Employment Land Strategy |

|

1.8 |

Draft Central Coast Employment Land Strategy - Public Exhibition |

|

Attachment 2 |

Draft Central Coast Employment Land Background Report |

|

Item No: 1.9 |

|

|

Title: Central Coast Air Show |

|

|

Department: Environment and Planning |

|

|

6 May 2025 Economic Development Committee |

|

Reference: F2024/00983 - D16750851

Author: Chris Barrett, Commercial Property Manager Commercial Property

Manager: Bill Ignatiadis, Unit Manager Economic Development and Property

Executive: Jamie Loader, Director Environment and Planning

That the Committee:

1 Notes the extensive insight into staging of future events at Central Coast (Warnervale) Airport gained through the after-event review of the 2024 Central Coast Air Show.

2 Acknowledges the resources and time needed to secure a suitable air show operator, gain the necessary approvals and undertake all necessary engagement with external stakeholders such as transport and emergency service agencies prior to staging future air shows on the Central Coast.

3 Endorses in principle the holding of future air shows at Central Coast (Warnervale) Airport.

4 Recommends to Council that a process to select a suitable air show operator commence as soon as possible, with a view to holding an air show at a suitable time in the 2026-27 financial year.

|

Report purpose

The purpose of this report is to inform the Economic Development Committee of the requirements for the holding of a major air show (taking into account learnings gained from an after-event review of the 2024 Central Coast Air Show) and to seek confirmation that there is in-principle support for the holding of an air show at Central Coast (Warnervale) Airport at some time between July 2026 and June 2027, with the actual date to be dependent on commercial and procedural considerations such as securing a suitable operator and obtaining all necessary event approvals.

Executive Summary

The holding of the most recent Central Coast Air Show at Warnervale on the weekend of 25 and 26 May 2024 drew large crowds and was generally regarded as a highlight of the Central Coast event calendar for 2024. However, staging the event did require a substantial level of Council oversight and approval facilitation and the devotion of substantial third-party resources (for example, to assess traffic management assessments) both in the lead up to the event and on the days of the event.

In particular, intensive and protracted negotiations were required with the air show operator and extensive engagement took place with key state government agencies (especially transport and emergency services).

This report informs the Committee as to the extensive requirements involved in staging a major air show and itemises the resources involved. It also seeks to establish the level of support for the holding of a further air show based on best practice for such events.

THE ATTACHMENT CONTAINS SENSITIVE AND CONFIDENTIAL INFORMATION |

Background

Several independently organised and operated air shows have been held at Central Coast Airport since Council took back responsibility for management of the airport a decade ago.

The on-day delivery of the 2024 Central Coast Air Show was generally regarded as being a successful event, and the level of attendee satisfaction and the attendee behaviour was clearly very positive.

However, extensive and protracted negotiation was required with the air show operator regarding essential event conduct conditions, and intensive negotiation was required with several state agencies to secure necessary approvals for the event to take place.

The venue for Central Coast Air Show is an attractive venue for the conduct of an air show, being close to major metropolitan centres, being uncontrolled airspace, experiencing generally favourable weather conditions and involving minimal impacts on adjoining landowners.

Nonetheless, there are substantial logistical challenges at this particular venue in conducting an air show or indeed any other high-patronage event on account of lack of on-site parking and lack of regular public transport as well as the absence of direct pedestrian access.

Added to this, there is an inherent level of risk in the conduct of any air show, on account of the dangers involved in close formation aerobatics manoeuvres and in proper containment management of fuel and other display materials, in addition to the management of large crowds in close proximity to on-ground aircraft operations.

From an economic development perspective, the air show provides two classes of benefits.

First, there are direct benefits to the local economy attributable to increase visitation and to spending in the local area. Although significant, these are not as substantial as for some other events.

A large proportion of attendees come from out-of-area on a one-day basis and do not spend elsewhere in the local area during their visit. Also, most service providers and stallholders came from outside the area. Normal flying operations at the airport are suspended during the air show (in effect, a week of trade is lost to the aero club and to council). As well, substantial council and state resources are devoted to obtaining approvals and setting up management protocols and providing a presence in the set-up and take down as well as on event days.

Second, there are indirect benefits from increased awareness of the presence and operations of the airport in the wider community. In essence, the air show promotes public awareness of the significant and growing presence of the Central Coast in the aviation sector as part of the overall Australian economy. While this should not be exaggerated, it is particularly important at a time when other niche aviation sites in the Sydney Basin are being displaced by urban growth and Western Sydney International Airport.

An after-event review was conducted by Council staff following the 2024 Central Coast Air Show that obtained substantial and specific feedback from a range of both internal and external stakeholders. The review was considered by senior Council management and has been taken into account in the preparation of this report.

On account of the candid and potentially sensitive nature of feedback received, the review is circulated on a separate and confidential basis to committee members.

Report

The prospect of development to occur on land which is integral to the conduct of the air show (both for actual air show operations and for spectator access and viewing and for associated stalls) it is unlikely that many future air shows are practicable. However, as noted previously, the Airport is a particular attractive venue for the conduct of an air show provided that sufficient time can be allowed to enter into a suitable agreement, obtain all necessary approvals and address key logistical issue, in particular arrangements for transport of air show patrons to and from the venue. Also, some operator interest has already been indicated to conduct further Air Shows at Central Coast Airport.

In

anticipation of support in principle to hold future events, the body of this

report covers two main items:

- It provides

a brief summary of air shows and air show operators in Australia.

- It provides an outline of planning needed to secure a further air show.

Overview of air shows and air show operators

In terms of air shows conducted in Australia, the two most notable events are Avalon (March) and Gold Coast (August).

There is no single source of reference as to future events, however, multiple trawls of internet event calendars have identified the following events on the annual air show calendar that may be relevant to the Central Coast event. Timing is approximate based on recent history.

JANUARY TO MARCH

Hunter Valley Air Show (Cessnock)

Illawarra Air Show (Shellharbour - Wings Downunder)

Tyabb Air Show (Victoria)

APRIL TO JUNE

Aldinga Air Show (South Australia)

Barossa Air Show (South Australia)

Central Coast Air Show (Warnervale)

Corowa Fly-In

JULY TO SEPTEMBER

Gold Coast Air Show

Mildura Air Show

OCTOBER TO DECEMBER

Warbirds Downunder (Temora)

Barrington Coast Air Show (Taree)

Newcastle Air Show

Only a small number of events are multi-day and the majority of identified events are run on an essentially voluntary basis by enthusiasts typically with a level of sponsorship by local or regional host council.

Some of these essentially voluntary events are run on an ad hoc basis only and not repeated, however, others have a track record with an ongoing local or regional following.

Of the enduring events, some are run at certified aerodromes (e.g. Gold Coast, Avalon. Illawarra) and other events are run at a diverse range of aircraft landing areas, typically airfields that are operated by local aero clubs.

There is a very small number of independent air show operators in Australia (independent means independent of the venue at which the event is operated).

Equally, very few commercial airports are willing to manage air shows in their own right, owing to the inherent commercial, logistical and insurance implications as well as the commercial losses due to interruptions to trading.

The main air show operator is the operator of the Australian International Air Show at Avalon airport, which is the Australian-based AMDA Foundation Limited.

Other air shows operated by AMDA include Temora (Warbirds Downunder) in NSW and Air Shows Downunder (formerly Wings over Illawara).

AMDA Foundation Limited delivers some of Australia’s largest and most prominent defence and aerospace industry expositions, programs and air shows. AMDA is a not-for-profit foundation, registered under the Australian Charities and Not-for-profits Commission Act, with no shareholders, no investors and no intent to pursue profit for its own sake. The Foundation’s mission is to promote the development of Australian industrial and technological resources, in the national interest.

A key stakeholder in many air shows is the ‘Royal Australian Air Force (RAAF)’: The RAAF is a major stakeholder in the Avalon Air Show, and they participate in the flying program with various aircraft displays and demonstrations.

Other well-established third-party operators include Paul Bennet Airshows (the operator of previous air shows at Warnervale) which is also a prominent contributor to air show flying displays, including at the Avalon Air Show.

The Gold Coast Air Show is operated by a U.S. based operator, Pacific Airshow, which began operations at Huntington Beach in California which has become the most attended air show in the United States. Pacific Airshow Gold Coast is a three-day weekend event featuring heart-pumping aerobatic demonstrations by the world’s finest aviators, VIP meet and greet events, social parties, family fun, licensed ticket precinct and more. Featuring some of the best civilian performers and military aviators from around the globe, Pacific Airshow claims to be the largest airshow to ever take place in Australia with more than 250,000 attendees.

Securing an event operator and obtaining event approvals

A starting point for the conduct of a successful air show is the event operator licence.

The event operator licence grants control of the airport site to the air show operator for the duration of the air show. As part of the operator licence, the air show operator is appointed as principal contractor for WHS purposes. This is a critical factor in managing Council’s underlying risk exposure.

A period of 4 months is considered reasonable for the conduct of negotiations to select an event operator and to enter a finalised licence with the selected operator.

Once the licence is in place, an event-specific development application can be submitted, approval for which can be granted with appropriate conditions by Council as consent authority on a one-off basis.

Obtaining the concurrence of key state agencies such as TfNSW is an essential requirement and as noted in the after-event review is likely to be subject to close scrutiny.

Based on recent experience, a period of at least 9 months from the grant of the event operator licence to the provision of development consent is involved, taking account of the various required state government agency concurrences.

Substantial operator effort is also required, particularly to procure remote locations for park & ride sites (where patrons leave their vehicles and transfer to buses).

A further buffer period of 3 months to gain other consent-driven approvals must be allowed.

In all, a period of at least 16 months is required to secure an operator, gain approvals and set up the event.

Based on support for an air show being confirmed by Council at its meeting in late May 2025, the earliest suitable date for the conduct of a future air show would appear to be the month of October 2026.

This would not appear to be in conflict with the dates of other national air shows such as Avalon and Gold Coast or regional shows at Cessnock (Hunter Valley) and Newcastle.

As there is a very limited number of established independent air show operators in Australia, the conduct of a formal expression of interest process may not be sufficient in itself to achieve the best outcome in terms of a future air show event on the Central Coast.

Accordingly, while also seeking expressions of interest, it is proposed to reach out directly to major air show operators to canvass their interest in operating an event at Warnervale.

Offers will be sought on the basis that:

- The operator is agreeable to enter in into a licence agreement on terms comparable to the 2024 Air Show Operator Licence

- The proposed event date is agreeable to both the operator and to Council

- The operator is responsible for obtaining all necessary development consents and event operational approvals (e.g. food stall approvals, emergency service participation agreements, NSWTF traffic-generating event approvals)

- All necessary insurances are obtained

- Exemption from payment of airport closure charges is provided

- No contribution towards direct event running costs is made by council

- DA assessment will occur on a no-submission-charge basis

- Concurrence of the Central Coast Aero Club to the proposed operating arrangements is obtained (note – access to and use of the privately-owned CCAC facility is essential for the conduct of the event)

Stakeholder Engagement

Internal and external stakeholder engagement is discussed elsewhere in this report and also in the attached confidential attachment.

Financial Considerations

Financial Year (FY) Implications.

The proposal has cost financial implications for the current FY and outer years in the LTFP.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes funding for this proposal.

The direct costs experienced by Council in facilitating third-party operation of previous Air Shows at Central Coast Airport (based on the costs experienced for the 2024 Air Show) are relatively modest, taking into account the scale and complexity of the event.

About 2 per cent (one week out of 52) of direct airport operating revenue is lost on account of the temporary closure of the airport (equivalent to $2,000 all up).

In addition, assessment of the event proposal and the negotiation of a suitable event operator licence requires a level of professional and management time, indicatively 2 to 2.5 months at senior professional rate spread between several sections & units of Council.

As well, on-site and near-site presence of monitoring and support staff is estimated at not more than three weeks at senior team member level.

Link to Community Strategic Plan

Theme 2: Smart

|

Goal C: A growing and competitive region |

|

S-C3: Facilitate economic development to increase local employment opportunities and provide a range of jobs for all residents. |

Risk Management

From the point of

view of Councill as venue owner, there is a spread of risks involved in holding

an air show.

These are initially managed via the preparation of a suitable event operator licence and the selection and the coming to agreement with a suitably experienced air show operator.

Thereafter, the risks are managed by the event operator obtaining and conforming with the multiple approvals required.

From the point of view of the event operator, there are major commercial and logistical risks, including event commerciality, availability of service providers, weather/climate, and conditions of event approval.

The allocation of risks must be strategically balanced to ensure both the eventual success of the event (measured most directly through patronage) and by ensuring compliance with major event best practice.

Critical Dates or Timeframes

The date on which a determination is made as to whether to seek a suitably experienced operator to conduct a further Air Show is made will determine the earliest available date on which the Air Show can be conducted.

A period of at least 16 months is required to negotiate a suitable operator licence and thereafter start obtaining event approvals and procuring event service providers etc.

Accordingly, if a determination is made to move forward at the Council meeting in late May 2025, the first available date for an event to be held will be early October 2026.

|

AAR Warnervale Airshow 2024 - |

Provided Under Separate Cover |

D16288544 |

|

Item No: 1.10 |

|

|

Title: Business Retention and Expansion Survey Report |

|

|

Department: Community and Recreation Services |

|

|

6 May 2025 Economic Development Committee |

|

Reference: F2025/00095 - D16779158

Author: Andrew Powrie, Business Economic Development Manager

Manager: Sue Ledingham, Unit Manager Customer Marketing and Economic Development

Executive: Phil Cantillon, Acting Director Community and Recreation Services

That the Committee:

1 Notes the Business Retention and Expansion Survey Report.

2 Endorses the Distribution of the Final Report to Business Industry and on Council’s website with supporting communications that will include Council’s actions underway and commitment to use the feedback for future service improvements.

3 Notes the survey results will be used to inform the research for the new economic development strategy and business concierge service.

|

Report purpose

The Central Coast Business Retention and Expansion (BRE) Survey was conducted online in September 2024. It consisted of questions across several areas that aimed to get an understanding of the sentiment and conditions affecting businesses on the Central Coast. There were 227 total surveys submitted. An insights report was prepared from the survey.

This report provides a summary of the insights, the full survey report, and recommendations for consideration by the Economic Development Committee on the publication of the BRE Insights report.

Executive Summary

Business Retention and Expansion is a program designed to support local businesses invested in community through survey interactions to gain local “business intelligence.”

The first Central Coast BRE survey was conducted in September 2024. From that survey Council has secured a wide array of business information and data insights from local businesses on the Central Coast. The insights from the survey will be used to inform the research for the new economic development strategy and business concierge service. This report provides a high-level summary of business respondents information, business opinions on the advantages and disadvantages of doing business on the Central Coast and a summary of key themes that were realised from verbatim open-ended questions in the survey. The full survey data insights report is also provided for consideration and review.

|

Background

Council’s Economic Development Committee requested the survey report (BRE Insights Report) at the first meeting in February 2025, this report actions that request.

Report

The Business Retention and Expansion (BRE) is a program designed to support and strengthen the local businesses that are invested in the local community through survey interactions to gain local “business intelligence”, that is shared with industry and stakeholders and translated into sharing information on services or programs that support local business growth. The first Central Coast BRE survey was conducted in September 2024.

The survey information and link were available through Your Voice Our Coast (Council’s engagement web page) and was communicated by traditional and social media channels, and via direct email through industry databases held at Council.

There were 227 total surveys submitted, of this 102 were completed having provided answers to the final questions. 125 submissions were partially completed, those that exercised the opt-out option.

Notwithstanding the opt-out question numbers, the vast majority of the questions had a response rate of at least 100+ businesses – so although the lesser numbers created a bias compared to total respondents, this was an information gathering exercise and 100+ businesses is a reasonable sample size.

Communications of the BRE Insights report is proposed as follows:

· The BRE Insights report is proposed to be made available on Council’s website and sent to all respondents. All respondents will be provided with a suite of information on support programs and services available for local businesses on the Central Coast.

· The regional advantages and disadvantages identified in the report from business feedback will be presented to the Central Coast Regional Economy Taskforce, which includes representatives from relevant government agencies.

The following information from the survey provides insights on types and sizes of business who responded, as well as the regional advantages and disadvantages of doing business on the Central Coast:

· The majority of business who completed the survey were small businesses with 5 or less employees.

· The majority of businesses were satisfied with their location.

· Time series data showed businesses have been consistently growing their employee numbers.

· 54% of businesses had a succession plan, 65% had an up-to-date business plan, and 54% had an up-to-date marketing plan.

Regional Advantages and Disadvantages:

· 82% of businesses viewed the quality of life on the Central Coast as an advantage.

· 55% of businesses noted access to skilled labour as a key disadvantage.

· Land costs and transportation availability/cost all received an at or about 40% rating of disadvantage, with availability of zoned land at 30%.

· The local permit process, with 64% saw it as a disadvantage to doing business.

· For access to markets 41% of businesses saw this as an advantage to doing business.

· 54% of businesses responded saying local government was a disadvantage.

Verbatim feedback on what could be improved:

· finding commercial spaces and skilled labour across all industry types

· improving transport and parking needs

· better business support from Council

· need for improved Council approval processes, and

· the need for improved streetscapes and built environment.

Further information:

· one third of all businesses said they would like to receive the BRE Insights report and further information on grant opportunities, resources, and business support programs available to them.

The insights from the survey will be used to inform the research for the new economic development strategy and business concierge service.

Stakeholder Engagement

Internal Stakeholders:

The survey results will be distributed internally, Economic Development staff will consult with business areas that were identified by respondents where there were issues and challenges.

External Stakeholders:

All respondents received communication from Council in December 2024 with the key early takeaways from the survey and a commitment to returning a full report in early 2025.

Financial Considerations

Financial Year (FY) Implications.

The proposal does not have financial implications for the current year or outer years in the LTFP.

Budget and Long-Term Financial Plan (LTFP) Impact.

The FY adopted budget includes the impact for this proposal.

Link to Community Strategic Plan

Theme 2: Smart

|

Goal C: A growing and competitive region |

|

S-C3: Facilitate economic development to increase local employment opportunities and provide a range of jobs for all residents. |

Risk Management

There is a likely

risk to Council’s reputation management regarding the feedback on the

planning issues. Recently Council’s Development Approval Forum addressed

several issues and concerns that have also been raised in the feedback

contained in the report.

There is a wide array of very positive data insights around the advantage of doing business on the Coast and businesses who have growth plans in place.

Risk mitigation proposed for the publication of the BRE Insights report would be to demonstrate how Councill will use the research to inform any new strategies and service review scheduled for 2025-26. Communication is proposed for the website to support the survey being published, this will include Council’s actions underway and commitment to use the feedback for future service improvements.

Critical Dates or Timeframes

Nil

|

1⇩ |

D16775786 Business Retention and Expansion Insights Report 08.04.2025 |

|

D16804696 |